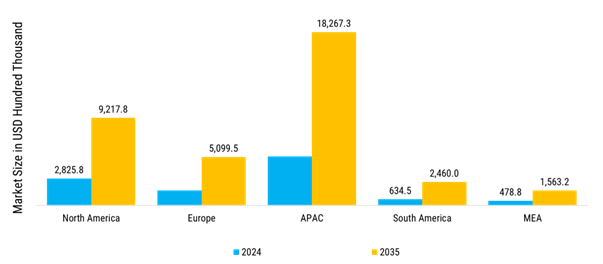

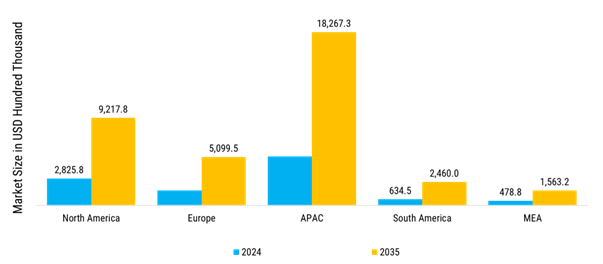

North America: Future Growth Reliable High-Speed Connectivity Solutions

North America represents one of the leading regions in the adoption and deployment of USB4 and it is expected to drive adoption as an ecosystem backed by its advanced technology, the strength of the semiconductor manufacturers, cloud service providers, and consumer electronics companies. The rapid acceleration of USB4 technology adoption in the region is driven by rapid adoption rates of high-performance laptops, ultrabooks, external storage drives, AR/VR systems, and next-gen displays featuring USB4's rich set of capabilities including 40 Gbps data throughput speeds, PCIe tunneling, and mandatory DisplayPort 2.1. Major players in the tech ecosystem, including the U.S. and Canada, are integrating USB4 into data center and enterprise server workloads and on AI driven platforms enabling faster connectivity for real-time analytics, machine learning, and edge-computing workloads. Defense, aerospace, automotive industries are also adopting USB4 for applications requiring low latency, ruggedized, and secure data transfer applications to meet mission-critical requirements.

Europe: Next-Generation High-Speed Connectivity

Europe is emerging a strategic market for USB4 adoption due to its emphasis on digital transformation, Industry 4.0 programs, and sustainable technology ecosystems. Countries like Germany, France, and the UK are leading the charge to implement USB4 in the automotive, aerospace, healthcare, and automation sectors. USB4 will support in-vehicle infotainment applications, near real-time navigation, and autonomous modules in the automotive space with its specifications of 40 Gbps of bandwidth, PCIe tunneling, and DisplayPort 2.1. The industrial equipment manufacturers throughout Europe are supporting USB4 as they power factory automation, robotics, and high-speed test and measurement systems that require low latency and resistance to EMI. In healthcare - imaging and diagnostics will gain better connectively to large format high-resolution displays, external GPUs, and secure data storage systems with USB4.

Asia-Pacific: Electrified And Connected Vehicles

Asia-Pacific is the fastest-growing region for USB4 adoption, buoyed by a large electronics manufacturing base, swift digitalization, and a range of consumer and enterprise device deployment. The main regions of solid identified growth come from countries like China, Japan, South Korea, Taiwan, and India. Key design houses, semiconductor foundries, original equipment manufacturers (OEMs), and original design manufacturers (ODMs) all miss driving assigned integration with USB4, while aggressively embedding into laptops and ultrabooks, smartphones, gaming peripherals, and external storage systems. Component requests are booming in the data center infrastructures across cloud service providers with USB4 as the growing workload in artificial intelligence, edge computing, and real-time analytics demands the 40 Gbps roadmap of USB4 with PCIe tunneling and DisplayPort 2.1 support. In automotive, USB4 is enabling a range of enabling features in advanced infotainment, augmented reality (AR) based heads-up displays, and autonomous driving ecosystem that aligns with the growing markets in electrified and connected vehicles in Asia. It is not just in automotive; similar developments are been identified in healthcare, industrial automation, and robotics, where USB4 signal low latency requirements, along with electromagnetic interference (EMI) immunity, create a powerful ecosystem where previously deployed devices can be still supported while providing backward compatibility requirements.

Middle East and Africa: New Applications Like Medical Imaging

USB4 is gaining traction in South America, supported by increasing investments in digital infrastructure, expanding consumer electronics, and enterprise IT modernization opportunities. Countries such as Brazil, Argentina, and Chile are leading the adoption in laptops, and external storage devices etc. that benefit from USB4's capabilities, including 40 maximum Gbps bandwidth, PCIe tunneling, and DisplayPort 2.1 with or without Display Stream Compression. These dynamic capabilities will add value and facilitate new data center socket solutions leveraging the adoption of USB4 for high-speed storage expansion, low-latency connectivity, mutually scalable virtualization solutions, and multi-cloud options to maintain remote working and other dynamic virtualization options for organizations. Health and education sectors are often adopting USB4 for new applications like medical imaging, imaging diagnostic systems, remote learning and digital platforms, and multi-display for teachers or remote education.

South America: Expanding Automotive And Defense

Progressive USB4 uptake is occurring throughout the Middle East and Africa (MEA) region. Prominent uptake is the result of increasing digital transformation investments, smart city initiatives and next-generation communication networks. Significant deployment is happening in UAE, Saudi Arabia and South Africa supported by the need for high-speed consumer electronics, enterprise IT infrastructure, and industrial automation etc. USB4's 40 Gbps bandwidth, PCIe tunnelling capabilities, and integrated DisplayPort 2.1 support will integrate well with the region's ongoing cloud-based data centres, 5G/6G infrastructure development and AI enabled platforms. USB4 will support the transformational potential to healthcare and education by offering real-time imaging, remote diagnostics, e-learning solutions and multi-streams on multi-monitor classroom environments.