Growing Regulatory Compliance Requirements

The Cloud Object Storage Market is increasingly shaped by the growing regulatory compliance requirements across various sectors. Organizations are compelled to adhere to stringent data protection regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). These regulations necessitate secure storage solutions that ensure data integrity and confidentiality. Cloud object storage providers are responding to this demand by implementing robust security measures and compliance certifications, making their offerings more attractive to businesses concerned about regulatory adherence. As compliance requirements continue to evolve, organizations are likely to migrate to cloud solutions that not only meet these standards but also provide the necessary tools for data management and reporting. This trend is expected to drive further growth in the cloud object storage market, as companies prioritize compliance in their storage strategies.

Cost Efficiency and Operational Flexibility

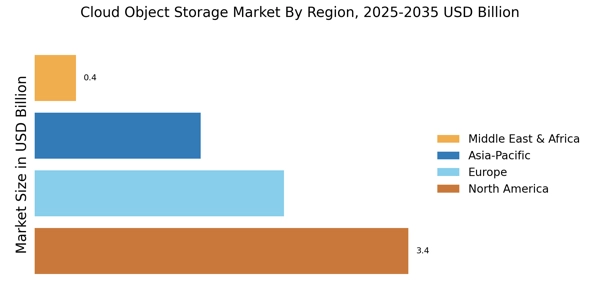

Cost efficiency remains a pivotal driver in the Cloud Object Storage Market. Organizations are increasingly drawn to cloud solutions due to their potential to reduce capital expenditures associated with traditional storage systems. By leveraging cloud object storage, businesses can convert fixed costs into variable costs, paying only for the storage they utilize. This model is particularly advantageous for startups and enterprises with fluctuating storage needs. Furthermore, operational flexibility is enhanced as cloud providers offer various pricing tiers and service levels, allowing organizations to tailor their storage solutions to specific requirements. As a result, the cloud object storage market is projected to grow at a compound annual growth rate of approximately 22% over the next few years, indicating a robust shift towards more cost-effective and adaptable storage solutions.

Rising Demand for Scalable Storage Solutions

The Cloud Object Storage Market experiences a notable surge in demand for scalable storage solutions. Organizations increasingly require flexible storage options that can grow with their data needs. This trend is driven by the exponential growth of data generated across various sectors, including healthcare, finance, and e-commerce. According to recent estimates, the volume of data created globally is expected to reach 175 zettabytes by 2025. As businesses seek to manage this data efficiently, cloud object storage offers a compelling solution, allowing for easy scalability without the need for significant upfront investment in physical infrastructure. This adaptability is particularly appealing to small and medium-sized enterprises, which may lack the resources for extensive on-premises storage systems. Consequently, the demand for cloud object storage solutions is likely to continue its upward trajectory, reflecting the industry's responsiveness to evolving storage requirements.

Increased Focus on Data Analytics and Insights

The Cloud Object Storage Market is significantly influenced by the growing emphasis on data analytics and insights. Organizations are increasingly recognizing the value of data-driven decision-making, prompting a surge in the volume of data being stored and analyzed. Cloud object storage provides a suitable environment for storing vast amounts of unstructured data, which is essential for advanced analytics applications. As businesses strive to extract actionable insights from their data, the need for efficient storage solutions that facilitate quick access and processing becomes paramount. This trend is further supported by the rise of artificial intelligence and machine learning technologies, which require substantial data inputs for training algorithms. Consequently, the demand for cloud object storage is expected to rise, as organizations seek to harness the power of their data while ensuring it is stored securely and efficiently.

Adoption of Advanced Technologies in Cloud Storage

The Cloud Object Storage Market is witnessing a transformative phase with the adoption of advanced technologies such as artificial intelligence, machine learning, and blockchain. These technologies enhance the capabilities of cloud object storage solutions, enabling organizations to optimize data management and security. For instance, AI and machine learning can automate data classification and retrieval processes, improving efficiency and reducing operational costs. Additionally, blockchain technology offers enhanced security features, ensuring data integrity and traceability. As organizations increasingly seek innovative solutions to manage their data, the integration of these advanced technologies into cloud object storage is likely to become a key differentiator in the market. This trend suggests a promising future for the cloud object storage industry, as it evolves to meet the complex demands of modern data management.