Increased Focus on Data Security

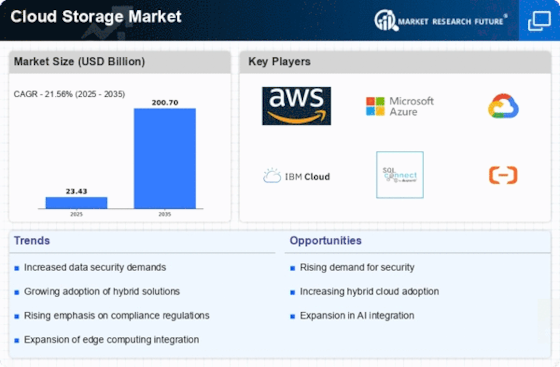

In the Cloud Storage Market, the emphasis on data security has intensified as organizations become more aware of the risks associated with data breaches and cyber threats. With the rise in regulatory requirements, such as the General Data Protection Regulation (GDPR), companies are compelled to adopt robust security measures to protect sensitive information. This has led to an increased investment in encryption technologies, access controls, and compliance solutions. As a result, cloud storage providers are enhancing their security offerings to meet these demands. The market for cloud security solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This focus on data security not only fosters trust among consumers but also drives the growth of the Cloud Storage Market as businesses prioritize secure storage options.

Rising Demand for Scalable Solutions

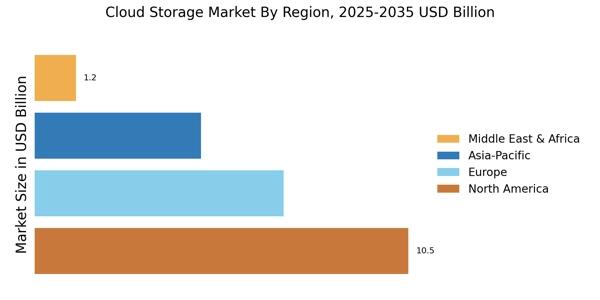

The Cloud Storage Market experiences a notable surge in demand for scalable storage solutions. Organizations increasingly require flexible storage options that can grow alongside their data needs. This trend is driven by the exponential growth of data generated across various sectors, including healthcare, finance, and e-commerce. According to recent estimates, the data generated worldwide is expected to reach 175 zettabytes by 2025. As businesses seek to manage this vast amount of information efficiently, they turn to cloud storage providers that offer scalable solutions. This shift not only enhances operational efficiency but also reduces costs associated with maintaining on-premises infrastructure. Consequently, the Cloud Storage Market is likely to witness significant growth as more enterprises adopt scalable cloud solutions to meet their evolving data storage requirements.

Growing Need for Disaster Recovery Solutions

The Cloud Storage Market is witnessing a growing need for disaster recovery solutions as businesses recognize the importance of data resilience. Natural disasters, cyberattacks, and system failures can lead to significant data loss, prompting organizations to invest in reliable backup and recovery solutions. Cloud storage offers an effective means of ensuring data redundancy and quick recovery in the event of an incident. According to industry reports, the disaster recovery as a service (DRaaS) market is projected to grow at a compound annual growth rate of over 30% in the next few years. This increasing demand for disaster recovery solutions is likely to drive the Cloud Storage Market, as organizations prioritize data protection and business continuity.

Expansion of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is significantly impacting the Cloud Storage Market. As more devices become interconnected, the volume of data generated is expected to increase exponentially. This surge in data necessitates robust cloud storage solutions capable of handling vast amounts of information generated by IoT devices. Industries such as manufacturing, healthcare, and smart cities are particularly affected, as they rely on real-time data analytics for decision-making. The market for IoT data storage is anticipated to grow substantially, with estimates suggesting that the number of connected devices will reach over 75 billion by 2025. This expansion presents a considerable opportunity for the Cloud Storage Market, as businesses seek efficient storage solutions to accommodate the influx of data from IoT devices.

Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies within the Cloud Storage Market is transforming how data is managed and analyzed. These technologies enable organizations to automate data management processes, optimize storage utilization, and enhance data retrieval efficiency. AI and ML algorithms can analyze vast amounts of data to identify patterns and trends, providing valuable insights for businesses. As organizations increasingly recognize the potential of AI and ML in improving operational efficiency, the demand for cloud storage solutions that incorporate these technologies is likely to rise. This trend is expected to contribute to the overall growth of the Cloud Storage Market, as companies seek innovative ways to leverage their data for competitive advantage.