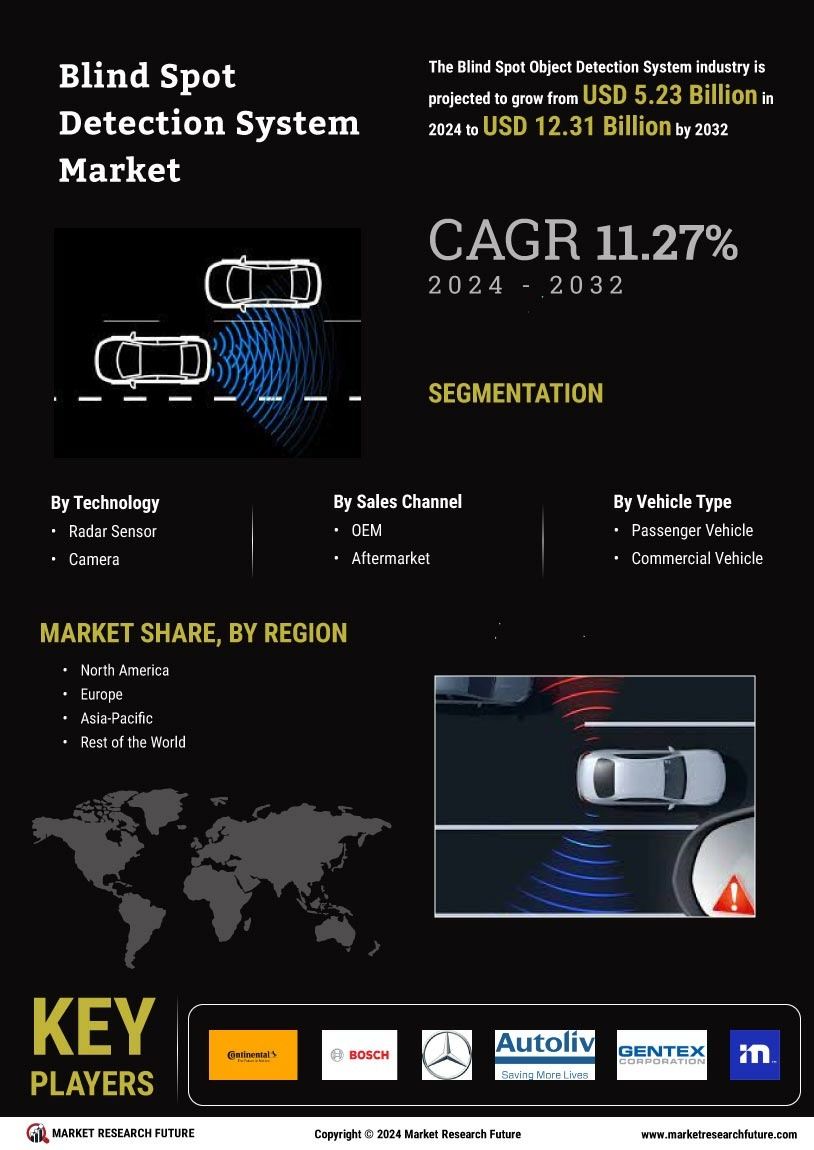

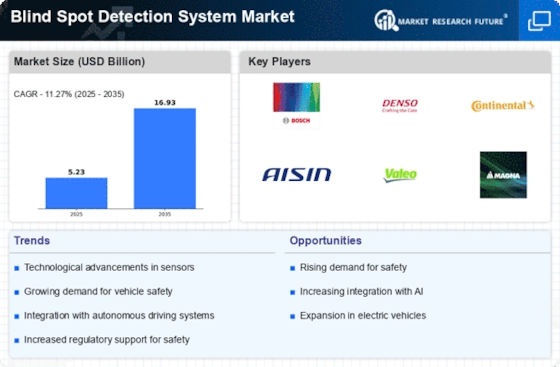

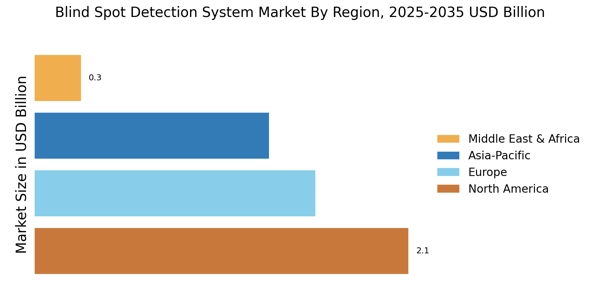

The Blind Spot Detection System Market is currently experiencing a notable transformation, driven by advancements in automotive technology and increasing consumer awareness regarding vehicle safety. As vehicles become more sophisticated, the integration of innovative safety features, such as blind spot detection systems, is becoming a standard expectation among consumers.

This shift is further fueled by regulatory bodies advocating for enhanced safety measures in vehicles, which appears to be influencing manufacturers to prioritize the development and implementation of these systems. Consequently, the market is witnessing a surge in demand, as consumers seek vehicles equipped with advanced safety technologies that can mitigate the risks associated with blind spots. Moreover, the Blind Spot Detection System Market is likely to benefit from the growing trend of electrification in the automotive sector. Electric vehicles, which are gaining traction, often come equipped with cutting-edge safety features, including blind spot detection systems.

This trend suggests that as the adoption of electric vehicles continues to rise, the demand for blind spot detection systems will also increase. Additionally, the ongoing development of autonomous driving technologies may further propel the market, as these systems are integral to ensuring safe navigation in complex driving environments. Overall, the blind spot object detection system market appears poised for substantial growth in the coming years, driven by technological advancements and evolving consumer preferences.

Technological Advancements

The Blind Spot Detection System Market is witnessing rapid technological advancements, particularly in sensor and camera technologies. These innovations enhance the accuracy and reliability of detection systems, making them more appealing to consumers. As manufacturers invest in research and development, the integration of artificial intelligence and machine learning into these systems is becoming more prevalent, potentially improving their functionality.

Increased Consumer Awareness

There is a growing awareness among consumers regarding vehicle safety features, which is influencing purchasing decisions. As individuals become more informed about the risks associated with blind spots, they are more likely to seek vehicles equipped with advanced detection systems. This trend indicates a shift in consumer priorities towards safety, thereby driving demand in the blind spot object detection system market .

Regulatory Influence

Regulatory bodies are increasingly advocating for enhanced safety measures in vehicles, which is impacting the Blind Spot Detection System Market. As governments implement stricter safety standards, manufacturers are compelled to incorporate advanced safety features, including blind spot detection systems, into their vehicle designs. This regulatory influence is likely to accelerate market growth as compliance becomes essential.