Increased Focus on Data Analytics

The cloud object-storage market in Canada is witnessing a heightened focus on data analytics capabilities. Organizations are increasingly recognizing the value of data-driven decision-making, which necessitates robust storage solutions that can support advanced analytics. The integration of cloud object-storage with analytics tools allows businesses to derive insights from their data more efficiently. This trend is particularly relevant in sectors such as retail and telecommunications, where real-time data analysis can lead to improved customer experiences and operational efficiencies. As a result, the cloud object-storage market is evolving to accommodate these analytical needs, with providers enhancing their offerings to include features that facilitate seamless data access and processing.

Emergence of Hybrid Cloud Solutions

The cloud object-storage market in Canada is also being shaped by the emergence of hybrid cloud solutions. Many organizations are adopting hybrid models that combine on-premises infrastructure with cloud storage, allowing for greater flexibility and control over their data. This approach enables businesses to optimize their storage strategies by balancing the benefits of both environments. The hybrid cloud model is particularly appealing to industries with sensitive data, as it allows for secure storage while still leveraging the scalability of cloud solutions. As a result, the cloud object-storage market is likely to see increased investment in hybrid solutions, catering to the diverse needs of Canadian enterprises.

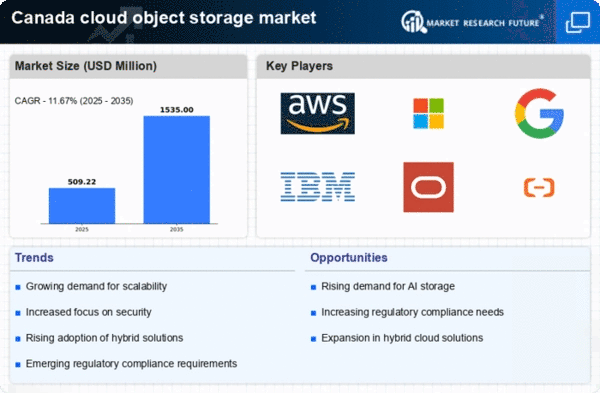

Growing Demand for Scalable Solutions

The cloud object-storage market in Canada is experiencing a notable surge in demand for scalable storage solutions. As businesses increasingly generate vast amounts of data, the need for flexible storage options that can grow with their requirements becomes paramount. This trend is particularly evident in sectors such as healthcare and finance, where data storage needs are expanding rapidly. According to recent estimates, the Canadian cloud object-storage market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by organizations seeking to optimize their data management strategies while ensuring that they can scale their storage capabilities without significant upfront investments. Consequently, the cloud object-storage market is positioned to benefit from this increasing demand for scalable and efficient storage solutions.

Regulatory Compliance and Data Sovereignty

In Canada, the cloud object-storage market is significantly influenced by regulatory compliance and data sovereignty concerns. Organizations are increasingly required to adhere to stringent data protection regulations, which necessitate the storage of data within national borders. This has led to a growing demand for cloud object-storage solutions that comply with Canadian laws and regulations. Companies are seeking providers that can ensure data residency and security, thereby mitigating risks associated with non-compliance. The cloud object-storage market is responding to this demand by offering solutions that prioritize data sovereignty, which is likely to enhance trust and adoption among Canadian businesses.

Shift Towards Cost-Effective Storage Solutions

In the context of the cloud object-storage market, Canadian enterprises are increasingly prioritizing cost-effective storage solutions. As organizations strive to manage their operational expenses, the appeal of cloud-based storage becomes more pronounced. The ability to pay only for the storage utilized, rather than investing in physical infrastructure, is a compelling proposition for many businesses. Reports indicate that companies can save up to 30% on storage costs by transitioning to cloud object-storage solutions. This financial incentive is particularly attractive for small and medium-sized enterprises (SMEs) that may lack the resources for extensive IT infrastructure. As a result, the cloud object-storage market is likely to see a continued influx of businesses seeking to leverage these cost-saving opportunities.