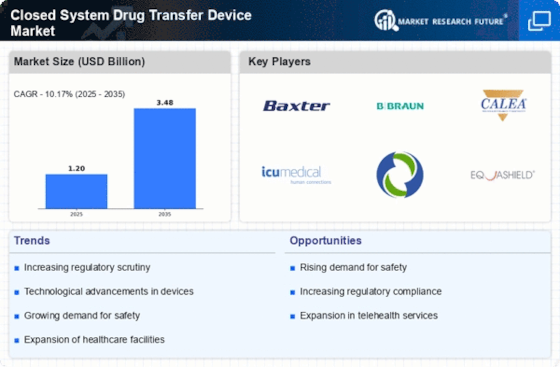

The Closed System Drug Transfer Device Market is currently characterized by a dynamic competitive landscape, driven by increasing regulatory scrutiny and a heightened focus on safety in drug handling. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and strategic partnerships to enhance their market positioning. For instance, Baxter International Inc (US) has been focusing on expanding its product portfolio through technological advancements, while B. Braun Melsungen AG (DE) is leveraging its strong global presence to penetrate emerging markets. These strategies collectively contribute to a competitive environment that is increasingly shaped by the need for enhanced safety protocols and efficient drug delivery systems.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation is indicative of a competitive environment where innovation and operational efficiency are paramount. The collective influence of key players, such as ICU Medical Inc (US) and Corvida Medical (US), is significant, as they continuously adapt to market demands and regulatory changes, thereby shaping the overall market dynamics.

In August 2025, ICU Medical Inc (US) announced the launch of a new line of closed system drug transfer devices designed to enhance safety and efficiency in drug preparation. This strategic move is likely to bolster the company’s market share by addressing the growing demand for safer drug handling solutions. The introduction of this product line not only reflects ICU Medical's commitment to innovation but also positions the company favorably against competitors who may not have similar offerings.

In September 2025, Corvida Medical (US) entered into a strategic partnership with a leading pharmaceutical company to co-develop advanced closed system drug transfer devices. This collaboration is expected to leverage both companies' strengths, potentially leading to enhanced product offerings and improved market penetration. Such partnerships are indicative of a trend where companies are seeking synergies to accelerate product development and meet evolving regulatory standards.

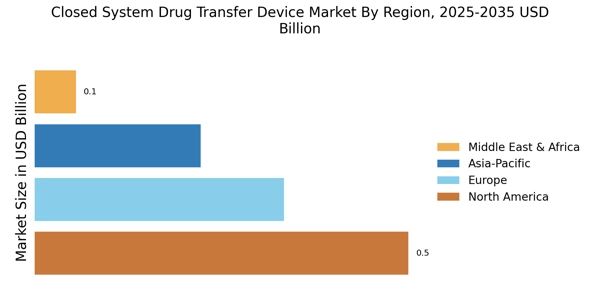

Furthermore, in July 2025, B. Braun Melsungen AG (DE) expanded its manufacturing capabilities in Asia to better serve the growing demand in that region. This expansion is strategically important as it not only enhances the company’s operational efficiency but also positions it to capitalize on the increasing market opportunities in Asia. By localizing production, B. Braun is likely to reduce costs and improve supply chain reliability, which is crucial in a market where timely delivery is essential.

As of October 2025, the competitive trends in the Closed System Drug Transfer Device Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to innovate and meet regulatory demands. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological innovation, enhanced safety features, and supply chain reliability. This shift suggests that companies that prioritize these aspects will likely gain a competitive edge in the market.