Rising Incidence of Chronic Diseases

The closed system-drug-transfer-device market is significantly influenced by the rising incidence of chronic diseases in the UK. With conditions such as cancer, diabetes, and autoimmune disorders becoming increasingly prevalent, the demand for effective drug delivery systems is on the rise. The National Health Service (NHS) has reported a steady increase in the number of patients requiring long-term medication, which in turn drives the need for safe and efficient drug transfer methods. This trend is expected to propel the closed system-drug-transfer-device market forward, as healthcare providers seek to ensure that patients receive their medications without the risk of exposure to hazardous substances. The market is anticipated to expand as more healthcare facilities adopt these devices to cater to the growing patient population with chronic conditions.

Growing Awareness of Occupational Hazards

The closed system-drug-transfer-device market is also being driven by the growing awareness of occupational hazards associated with drug handling. Healthcare professionals are increasingly recognizing the risks posed by exposure to hazardous drugs, which can lead to serious health issues. This awareness is prompting healthcare organizations to implement measures that protect their staff, including the adoption of closed system-drug-transfer devices. As a result, the market is likely to see a rise in demand as facilities seek to create safer working environments. The emphasis on occupational safety is expected to contribute to the overall growth of the closed system-drug-transfer-device market, as more organizations prioritize the health and well-being of their employees.

Regulatory Support for Safe Drug Handling

Regulatory support for safe drug handling practices is a crucial driver for the closed system-drug-transfer-device market. The UK government and health authorities have implemented stringent regulations aimed at ensuring the safe handling of hazardous drugs. These regulations not only mandate the use of closed system-drug-transfer devices in certain healthcare settings but also encourage the adoption of best practices in drug administration. As compliance with these regulations becomes increasingly important, healthcare facilities are likely to invest in closed system-drug-transfer devices to meet legal requirements. This regulatory landscape is expected to foster growth in the market, as facilities prioritize compliance and patient safety.

Increasing Demand for Safety in Healthcare

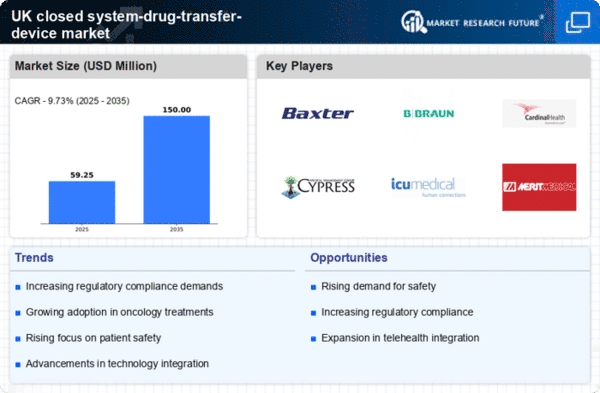

The closed system-drug-transfer-device market is experiencing a notable surge in demand driven by the increasing emphasis on safety within healthcare settings. As healthcare providers strive to minimize the risk of exposure to hazardous drugs, the adoption of closed system-drug-transfer devices is becoming more prevalent. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years. This growth is largely attributed to the heightened awareness of the potential dangers associated with drug handling, which has prompted healthcare facilities to invest in safer drug transfer solutions. Consequently, the closed system-drug-transfer-device market is positioned to benefit from this trend, as hospitals and clinics prioritize the implementation of devices that enhance safety and reduce the likelihood of contamination.

Technological Innovations in Drug Delivery

Technological innovations are playing a pivotal role in shaping the closed system-drug-transfer-device market. The introduction of advanced materials and designs has led to the development of more efficient and user-friendly devices. Innovations such as integrated safety features and real-time monitoring capabilities are enhancing the functionality of these devices, making them more appealing to healthcare providers. As the market evolves, it is likely that these technological advancements will continue to drive growth, with an expected increase in market value reaching £500 million by 2027. The closed system-drug-transfer-device market is thus positioned to benefit from ongoing research and development efforts aimed at improving drug delivery systems.