Regulatory Support and Guidelines

The closed system-drug-transfer-device market in Italy is benefiting from robust regulatory support aimed at enhancing drug safety. Regulatory agencies are increasingly establishing guidelines that mandate the use of closed systems for the handling of hazardous drugs. This regulatory framework is designed to protect healthcare workers and patients from potential exposure to toxic substances. As a result, healthcare facilities are compelled to adopt closed system-drug-transfer devices to comply with these regulations. The market is likely to see a steady increase in adoption rates, with estimates suggesting that compliance-driven purchases could account for up to 30% of the market growth in the coming years. This regulatory environment is fostering a culture of safety and accountability within the healthcare sector.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in Italy is contributing significantly to the expansion of the closed system-drug-transfer-device market. As the population ages, the incidence of conditions such as cancer and diabetes is on the rise, necessitating the use of effective drug delivery systems. Closed system-drug-transfer devices are increasingly recognized for their role in safely administering chemotherapy and other hazardous medications. This growing need is underscored by statistics indicating that nearly 25% of the Italian population is expected to be over 65 years old by 2030, which will likely increase the demand for safe drug administration methods. Consequently, healthcare providers are investing in closed system-drug-transfer devices to enhance patient safety and treatment efficacy.

Increasing Demand for Safety in Healthcare

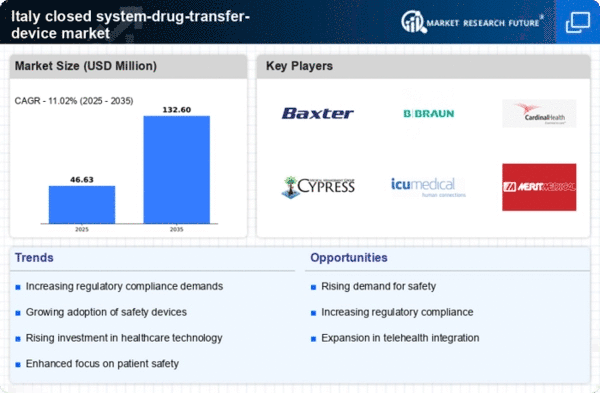

The closed system-drug-transfer-device market in Italy is experiencing a notable surge in demand driven by heightened awareness of safety protocols in healthcare settings. Hospitals and clinics are increasingly prioritizing the protection of healthcare workers and patients from hazardous drug exposure. This shift is reflected in the growing adoption of closed system-drug-transfer devices, which are designed to minimize the risk of contamination and exposure. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust trend towards safer drug handling practices. The emphasis on safety is further supported by regulatory bodies advocating for stringent safety measures, thereby propelling the closed system-drug-transfer-device market forward.

Technological Innovations in Drug Delivery

Technological advancements are playing a pivotal role in shaping the closed system-drug-transfer-device market in Italy. Innovations such as smart devices equipped with real-time monitoring capabilities are enhancing the efficiency and safety of drug delivery systems. These advancements not only improve the accuracy of drug administration but also provide healthcare professionals with valuable data to optimize treatment protocols. The integration of technology into closed system-drug-transfer devices is expected to attract significant investment, with projections suggesting a market growth of around 10% annually over the next few years. This trend indicates a shift towards more sophisticated and user-friendly drug delivery solutions, thereby driving the closed system-drug-transfer-device market.

Growing Focus on Environmental Sustainability

There is a rising emphasis on environmental sustainability within the healthcare sector in Italy, which is influencing the closed system-drug-transfer-device market. As healthcare providers seek to reduce their environmental footprint, the demand for eco-friendly drug delivery systems is increasing. Closed system-drug-transfer devices that are designed with recyclable materials or that minimize waste are becoming more appealing to healthcare facilities. This trend aligns with broader sustainability goals set by the Italian government, which aims to promote environmentally responsible practices across various industries. The market may witness a shift towards products that not only ensure safety but also contribute to environmental conservation, potentially driving growth in the closed system-drug-transfer-device market.