Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are significantly influencing the closed system-drug-transfer-device market. In France, the government has allocated substantial funding to enhance hospital facilities and promote the adoption of safety-compliant medical devices. This financial support is likely to encourage healthcare institutions to invest in closed system-drug-transfer-devices, thereby driving market growth. The closed system-drug-transfer-device market stands to benefit from these initiatives, as they not only facilitate access to advanced technologies but also promote adherence to safety regulations. As a result, the market is expected to witness a steady increase in demand, particularly from public healthcare facilities.

Rising Awareness of Safety Protocols

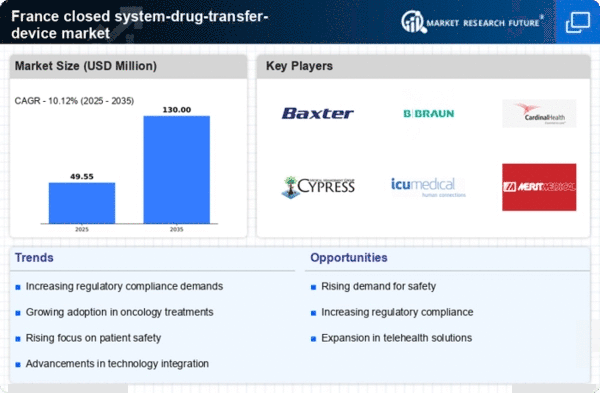

The increasing awareness of safety protocols among healthcare professionals is a crucial driver for the closed system-drug-transfer-device market. As hospitals and clinics prioritize patient and staff safety, the demand for devices that minimize exposure to hazardous drugs is likely to rise. In France, regulatory bodies have emphasized the importance of using closed systems to prevent contamination and ensure safe handling of cytotoxic drugs. This heightened focus on safety is reflected in the market, which is projected to grow at a CAGR of approximately 8% over the next five years. The closed system-drug-transfer-device market is thus experiencing a shift towards products that comply with stringent safety standards, ultimately enhancing the overall quality of healthcare delivery.

Focus on Environmental Sustainability

The emphasis on environmental sustainability is emerging as a notable driver in the closed system-drug-transfer-device market. In France, there is a growing concern regarding the environmental impact of medical waste, particularly from hazardous drug handling. As healthcare facilities strive to adopt more sustainable practices, the demand for closed system-drug-transfer-devices that minimize waste and enhance safety is likely to increase. This shift towards sustainability not only aligns with regulatory expectations but also resonates with the values of healthcare providers and patients alike. The closed system-drug-transfer-device market is thus positioned to benefit from this trend, as manufacturers develop eco-friendly solutions that meet both safety and environmental standards.

Growing Incidence of Chronic Diseases

The rising incidence of chronic diseases in France is a significant driver for the closed system-drug-transfer-device market. As the population ages and the prevalence of conditions such as cancer and diabetes increases, the need for safe and effective drug delivery systems becomes more pronounced. Healthcare providers are increasingly recognizing the importance of using closed systems to mitigate risks associated with hazardous drug exposure. This trend is likely to propel the closed system-drug-transfer-device market forward, as more healthcare facilities seek to implement these devices in their treatment protocols. The market is projected to expand as a direct response to the growing demand for safer drug administration methods.

Technological Innovations in Drug Delivery

Technological innovations play a pivotal role in shaping the closed system-drug-transfer-device market. The introduction of advanced materials and designs that enhance the efficacy and safety of drug transfer systems is becoming increasingly prevalent. In France, manufacturers are investing in research and development to create devices that not only meet regulatory requirements but also improve user experience. For instance, the integration of smart technology in drug delivery systems is expected to streamline operations and reduce the risk of human error. This trend indicates a potential increase in market share for companies that can successfully innovate within the closed system-drug-transfer-device market, as healthcare providers seek more efficient and reliable solutions.