Focus on Healthcare Cost Reduction

In the context of Germany's healthcare system, there is a growing emphasis on cost reduction strategies. The closed system-drug-transfer-device market is likely to benefit from this trend as healthcare providers seek to minimize expenses associated with drug administration and waste management. By utilizing closed system devices, hospitals and clinics can potentially reduce the costs related to drug spills and contamination incidents. Reports suggest that implementing these systems could lead to savings of up to €500,000 annually for larger healthcare facilities, thereby making a compelling case for the adoption of closed system-drug-transfer-devices.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in Germany is on the rise, which is significantly impacting the closed system-drug-transfer-device market. As the population ages and lifestyle-related health issues become more common, the demand for effective drug delivery systems is increasing. Chronic conditions such as cancer, diabetes, and cardiovascular diseases require consistent and safe medication administration, which closed system-drug-transfer-devices can provide. Market analysis indicates that the demand for these devices could increase by as much as 15% in the next few years, driven by the need for reliable and safe drug transfer methods in treating chronic illnesses.

Increasing Demand for Safety Features

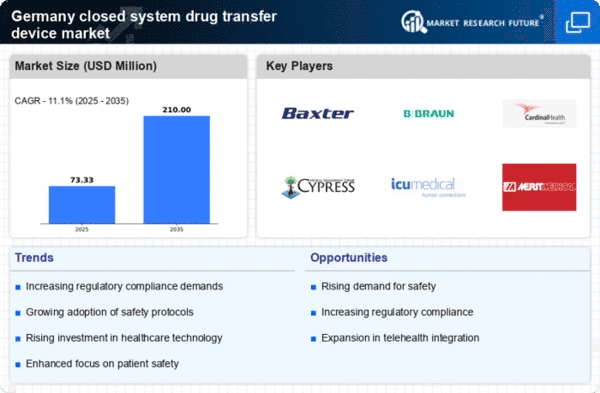

The closed system-drug-transfer-device market in Germany is experiencing a notable surge in demand for enhanced safety features. This trend is largely driven by the increasing awareness of the risks associated with hazardous drug handling. Healthcare professionals are increasingly prioritizing devices that minimize exposure to toxic substances, thereby reducing the likelihood of contamination and ensuring patient safety. According to recent data, the market for safety-engineered devices is projected to grow at a CAGR of approximately 8% over the next five years. This growth reflects a broader shift towards prioritizing safety in healthcare settings, which is likely to bolster the closed system-drug-transfer-device market.

Regulatory Support for Safe Drug Handling

Regulatory bodies in Germany are increasingly supporting initiatives aimed at ensuring safe drug handling practices. This regulatory environment is fostering growth in the closed system-drug-transfer-device market, as compliance with safety standards becomes a priority for healthcare providers. New regulations are likely to mandate the use of closed systems in specific settings, thereby driving market expansion. The anticipated regulatory changes could lead to a market growth of approximately 12% over the next few years, as healthcare facilities adapt to meet these new requirements and enhance patient safety.

Advancements in Drug Formulation Technologies

The closed system-drug-transfer-device market is being positively influenced by advancements in drug formulation technologies. As pharmaceutical companies in Germany innovate and develop new drug formulations, the need for compatible delivery systems becomes critical. These advancements often require specialized devices that can safely handle complex drug compositions, which closed system-drug-transfer-devices are designed to accommodate. The market is expected to see a growth rate of around 10% as these technologies evolve, indicating a strong correlation between drug formulation innovations and the demand for effective drug transfer solutions.