Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is a primary driver of the Clinical Diagnostic Market. As populations age and lifestyle-related health issues become more common, the demand for diagnostic tests rises. For instance, the World Health Organization indicates that chronic diseases account for approximately 70% of all deaths worldwide. This trend necessitates advanced diagnostic solutions to facilitate early detection and management, thereby propelling market growth. Furthermore, the Clinical Diagnostic Market is likely to expand as healthcare providers seek to implement more comprehensive screening programs to address these health challenges.

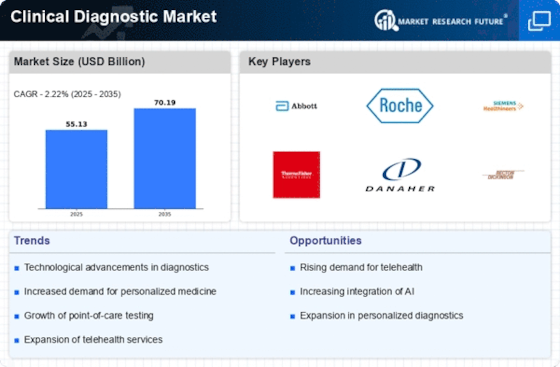

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into diagnostic processes is transforming the Clinical Diagnostic Market. AI technologies enhance the accuracy and efficiency of diagnostic tests, enabling faster and more reliable results. For example, AI algorithms can analyze medical images with precision, assisting radiologists in identifying abnormalities. The market for AI in healthcare is projected to reach substantial figures, indicating a robust growth trajectory. This technological advancement not only improves patient outcomes but also streamlines workflows in clinical settings, thereby driving the Clinical Diagnostic Market forward. As healthcare systems increasingly adopt AI solutions, the potential for innovation in diagnostics appears vast.

Growing Demand for Point-of-Care Testing

The demand for point-of-care testing (POCT) is surging within the Clinical Diagnostic Market, driven by the need for rapid and accessible diagnostic solutions. POCT allows for immediate results, facilitating timely clinical decisions and improving patient management. The market for POCT is expected to witness significant growth, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend is particularly evident in settings such as emergency departments and outpatient clinics, where quick diagnostics are essential. As healthcare providers increasingly prioritize patient-centric care, the Clinical Diagnostic Market is likely to adapt to these evolving needs.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among populations, which is significantly influencing the Clinical Diagnostic Market. Individuals are increasingly recognizing the importance of early detection and regular health screenings to prevent disease progression. This shift in mindset is driving demand for various diagnostic tests, including routine blood tests, genetic screenings, and imaging studies. As healthcare systems promote preventive measures, the Clinical Diagnostic Market is likely to experience sustained growth. Furthermore, public health campaigns aimed at educating communities about the benefits of preventive care are expected to further enhance the uptake of diagnostic services.

Increased Investment in Research and Development

Investment in research and development (R&D) within the Clinical Diagnostic Market is a crucial driver of innovation and growth. Pharmaceutical companies and diagnostic manufacturers are allocating substantial resources to develop novel diagnostic tests and technologies. This focus on R&D is essential for addressing unmet medical needs and enhancing diagnostic capabilities. For instance, advancements in molecular diagnostics and genomics are reshaping the landscape of disease detection and management. The Clinical Diagnostic Market is expected to benefit from these innovations, as they lead to more precise and personalized healthcare solutions, ultimately improving patient outcomes.