Advancements in Genomic Technologies

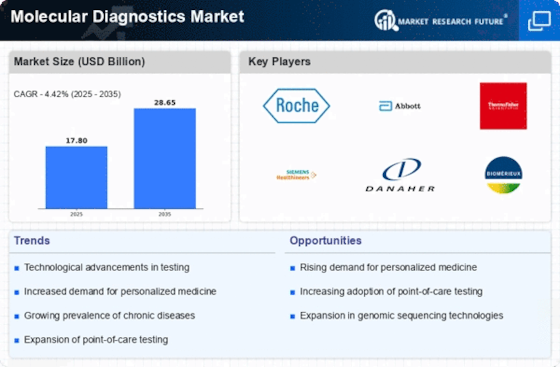

Technological innovations in genomic sequencing and analysis are significantly influencing the Molecular Diagnostics Market. The advent of next-generation sequencing (NGS) has revolutionized the ability to analyze genetic material rapidly and cost-effectively. This has led to a surge in the development of molecular diagnostic tests that can identify genetic mutations associated with various diseases. The market for NGS is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. Such advancements not only enhance the accuracy of diagnostics but also facilitate the emergence of personalized medicine approaches, where treatments are tailored based on individual genetic profiles. Consequently, the integration of these technologies into clinical practice is likely to drive the expansion of the Molecular Diagnostics Market.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver of the Molecular Diagnostics Market. As these conditions become more prevalent, the demand for accurate and timely diagnostic tools intensifies. Molecular diagnostics offer precise insights into disease mechanisms, enabling healthcare providers to tailor treatment plans effectively. According to recent data, the prevalence of cancer is projected to rise, with an estimated 23 million new cases by 2030. This surge necessitates advanced diagnostic solutions, thereby propelling the growth of the Molecular Diagnostics Market. Furthermore, the ability of molecular diagnostics to detect diseases at an early stage enhances patient outcomes, which is increasingly recognized by healthcare systems worldwide.

Growing Demand for Point-of-Care Testing

The rising demand for point-of-care testing (POCT) is emerging as a significant driver of the Molecular Diagnostics Market. POCT allows for rapid diagnostic results at or near the site of patient care, which is particularly advantageous in emergency and remote settings. The convenience and speed of POCT can lead to timely clinical decisions, improving patient management. Recent estimates suggest that the POCT market is expected to grow at a compound annual growth rate of approximately 10% over the next few years. This growth is fueled by advancements in molecular diagnostic technologies that enable the development of portable and user-friendly testing devices. As healthcare systems increasingly prioritize accessibility and efficiency, the integration of molecular diagnostics into POCT is likely to enhance the overall effectiveness of healthcare delivery, thereby driving the Molecular Diagnostics Market.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is reshaping the landscape of the Molecular Diagnostics Market. As healthcare systems emphasize early detection and prevention of diseases, molecular diagnostics play a crucial role in identifying risk factors and disease markers. This proactive approach is supported by data indicating that early diagnosis can reduce healthcare costs significantly. For instance, early detection of certain cancers can lead to treatment that is less invasive and more effective, ultimately improving patient survival rates. The growing awareness among patients and healthcare providers about the benefits of preventive measures is likely to drive demand for molecular diagnostic tests. This trend aligns with the broader movement towards value-based care, where outcomes are prioritized over volume, further propelling the Molecular Diagnostics Market.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are vital drivers of the Molecular Diagnostics Market. Governments and health authorities are increasingly recognizing the importance of molecular diagnostics in improving patient care and outcomes. This recognition has led to streamlined approval processes for new diagnostic tests, facilitating quicker market entry. Additionally, reimbursement policies that cover molecular diagnostic tests encourage healthcare providers to adopt these technologies. For example, certain countries have implemented reimbursement codes specifically for molecular tests, which enhances accessibility for patients. As reimbursement landscapes evolve to support innovative diagnostic solutions, the Molecular Diagnostics Market is likely to experience accelerated growth, as more healthcare providers integrate these tests into routine clinical practice.