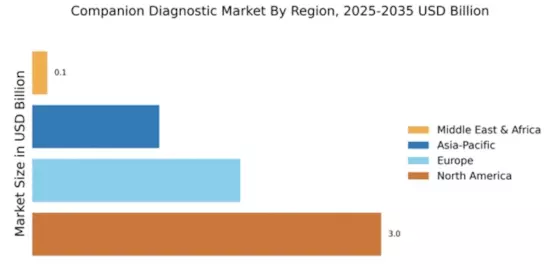

North America : Market Leader in Diagnostics

North America accounted for the largest share of the global Companion Diagnostics Market size, reaching USD 3 billion in 2024. The region's growth is driven by increasing demand for personalized medicine, advancements in genomic technologies, and supportive regulatory frameworks. The FDA's initiatives to expedite the approval of companion diagnostics further enhance market dynamics, fostering innovation and accessibility.

The United States stands as the primary contributor, with major players like Roche, Thermo Fisher Scientific, and Abbott Laboratories leading the competitive landscape. The presence of advanced healthcare infrastructure and substantial investments in R&D bolster the market. As the region continues to embrace precision medicine, the competitive environment is expected to intensify, with collaborations and partnerships becoming more prevalent.

Europe : Emerging Market Potential

Europe is witnessing a burgeoning Companion Diagnostic Market, projected to reach $1.8B by 2025. The region benefits from a robust regulatory environment, with the European Medicines Agency (EMA) actively promoting the integration of diagnostics in therapeutic pathways. Increasing prevalence of chronic diseases and a shift towards personalized medicine are key growth drivers, alongside government initiatives to enhance healthcare access.

Leading countries such as Germany, France, and the UK are at the forefront, with significant contributions from companies like Qiagen and Illumina. The competitive landscape is characterized by a mix of established players and innovative startups, fostering a dynamic market. The emphasis on precision medicine and tailored therapies is expected to drive further investments and collaborations in the coming years.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a significant player in the Companion Diagnostic Market, with a projected size of $1.1B by 2025. Factors such as increasing healthcare expenditure, rising awareness of personalized medicine, and government support for biotechnology are driving market growth. Regulatory bodies are also enhancing frameworks to facilitate the approval of innovative diagnostic solutions, contributing to a favorable market environment.

Countries like China, Japan, and India are leading the charge, with a growing presence of key players such as Myriad Genetics and Agilent Technologies. The competitive landscape is evolving, with local companies increasingly entering the market. As the region continues to invest in healthcare infrastructure and research, the demand for companion diagnostics is expected to surge, creating new opportunities for growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region represents an untapped market for companion diagnostics, with a market size of $0.13B projected for 2025. The growth in this region is driven by increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and a growing focus on personalized medicine. Regulatory bodies are beginning to establish frameworks to support the development and approval of diagnostic tools, which is crucial for market expansion.

Countries such as South Africa and the UAE are leading the way, with a mix of local and international players entering the market. The competitive landscape is still developing, but there is significant potential for growth as awareness of companion diagnostics increases. As healthcare systems evolve, the demand for innovative diagnostic solutions is expected to rise, paving the way for new entrants and collaborations.