Increased Regulatory Scrutiny

Increased regulatory scrutiny in various industries, particularly in pharmaceuticals and food safety, is a significant driver for the Chromatography Data System Market. Regulatory bodies are enforcing stricter guidelines to ensure product safety and efficacy, which necessitates comprehensive analytical testing. Companies are therefore investing in chromatography data systems to streamline compliance processes and maintain accurate records of their testing activities. The market is expected to grow as organizations seek to enhance their data management capabilities to meet these regulatory demands, ensuring that they can provide reliable and traceable analytical results.

Emergence of Personalized Medicine

The emergence of personalized medicine is reshaping the landscape of the Chromatography Data System Market. As healthcare shifts towards tailored treatments based on individual patient profiles, the demand for precise analytical techniques becomes paramount. Chromatography plays a crucial role in the development and monitoring of personalized therapies, necessitating robust data management systems to handle the intricate data involved. The market is likely to see an increase in the adoption of chromatography data systems that can support the unique requirements of personalized medicine, including the analysis of biomarker profiles and drug interactions.

Rising Demand for Analytical Testing

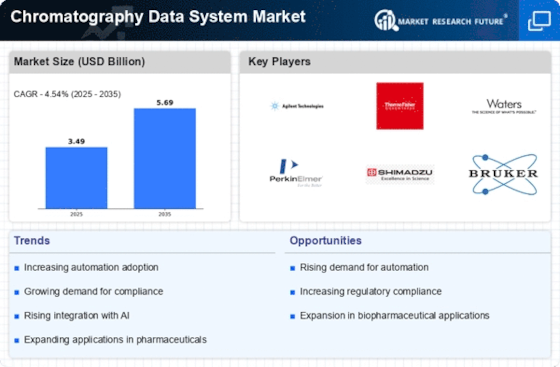

The increasing demand for analytical testing across various industries, including pharmaceuticals, food and beverage, and environmental monitoring, is a key driver for the Chromatography Data System Market. As regulatory standards become more stringent, companies are compelled to adopt advanced analytical techniques to ensure compliance. The market for analytical testing is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 7% in the coming years. This growth is likely to propel the adoption of chromatography data systems, which facilitate efficient data management and analysis, thereby enhancing productivity and accuracy in testing processes.

Growing Focus on Research and Development

A growing focus on research and development (R&D) activities in various sectors, particularly in pharmaceuticals and biotechnology, is significantly influencing the Chromatography Data System Market. Increased investment in R&D is aimed at developing new drugs and therapies, which necessitates extensive analytical testing. This trend is expected to drive the demand for chromatography data systems, as they provide essential support in managing and analyzing complex data generated during R&D processes. The pharmaceutical sector alone is projected to allocate a substantial portion of its budget to R&D, further fueling the need for efficient data management solutions.

Technological Advancements in Chromatography

Technological advancements in chromatography techniques, such as ultra-high-performance liquid chromatography (UHPLC) and gas chromatography-mass spectrometry (GC-MS), are driving the evolution of the Chromatography Data System Market. These innovations enhance the resolution, speed, and sensitivity of analyses, making them indispensable in research and quality control. The integration of sophisticated software solutions with these advanced techniques allows for better data handling and interpretation. As a result, the market is witnessing a surge in demand for chromatography data systems that can seamlessly integrate with these cutting-edge technologies, thereby improving laboratory efficiency and data accuracy.