Government Support and Policy Initiatives

The China Robotics Market benefits significantly from robust government support and policy initiatives aimed at fostering technological advancement. The Chinese government has implemented various policies, such as the Made in China 2025 strategy, which emphasizes the development of high-tech industries, including robotics. This initiative aims to elevate the domestic robotics sector, with a target of achieving a market size of 100 billion yuan by 2025. Furthermore, local governments are providing financial incentives and subsidies to encourage the adoption of robotics in manufacturing and other sectors. This supportive environment is likely to accelerate innovation and growth within the China Robotics Market, positioning it as a global leader in robotics technology.

Technological Advancements and Innovation

Technological advancements play a pivotal role in shaping the China Robotics Market. The rapid evolution of robotics technology, including improvements in artificial intelligence, machine learning, and sensor technologies, is driving the development of more sophisticated robotic systems. For instance, collaborative robots, or cobots, are gaining traction in various industries, allowing for safer human-robot interactions. The market for industrial robots in China is projected to reach 200 billion yuan by 2026, reflecting the increasing adoption of advanced robotics solutions. This continuous innovation not only enhances operational efficiency but also expands the application scope of robotics across diverse sectors, thereby propelling the growth of the China Robotics Market.

Rising Labor Costs and Workforce Shortages

The China Robotics Market is experiencing a surge in demand for automation solutions due to rising labor costs and workforce shortages. As the country undergoes rapid urbanization and industrialization, the cost of labor has escalated, prompting manufacturers to seek efficient alternatives. According to recent data, labor costs in China have increased by approximately 10% annually over the past few years. This trend has led to a growing interest in robotics, particularly in sectors such as manufacturing, logistics, and agriculture. Companies are increasingly investing in robotic solutions to enhance productivity and maintain competitiveness. Consequently, the China Robotics Market is poised for substantial growth as businesses strive to automate processes and mitigate the impact of labor shortages.

Growing Demand for Automation in Manufacturing

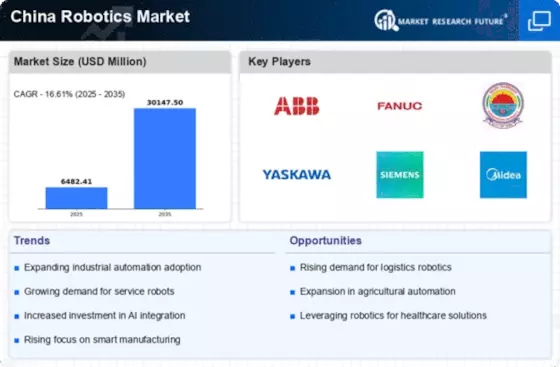

The demand for automation in manufacturing is a key driver of the China Robotics Market. As manufacturers seek to improve efficiency, reduce production costs, and enhance product quality, the adoption of robotic systems has become increasingly prevalent. The Chinese manufacturing sector is undergoing a transformation, with a focus on smart manufacturing and Industry 4.0 principles. Reports indicate that the market for industrial robots in China is expected to grow at a compound annual growth rate of 15% over the next five years. This trend is indicative of the broader shift towards automation, as companies recognize the potential of robotics to streamline operations and respond to market demands more effectively. The China Robotics Market is thus positioned to thrive in this evolving landscape.

Expansion of Robotics Applications in Various Sectors

The expansion of robotics applications across various sectors is significantly influencing the China Robotics Market. Beyond traditional manufacturing, robotics is increasingly being integrated into sectors such as healthcare, agriculture, and logistics. For example, the use of robotic surgical systems in hospitals is on the rise, enhancing precision and patient outcomes. In agriculture, autonomous drones and robotic harvesters are revolutionizing farming practices, improving efficiency and yield. The logistics sector is also witnessing the deployment of automated guided vehicles (AGVs) to streamline warehouse operations. This diversification of applications is likely to drive growth in the China Robotics Market, as businesses across different sectors recognize the benefits of adopting robotic technologies.