Hospitality Automation

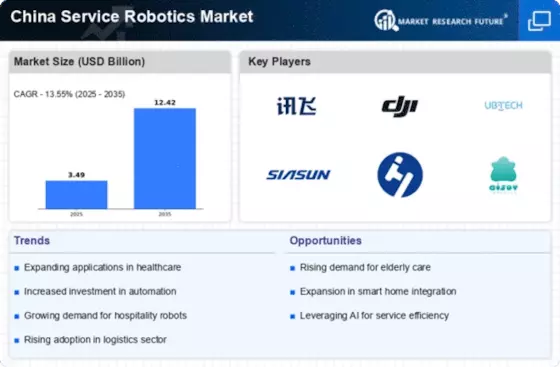

The hospitality sector in China is increasingly adopting service robotics to enhance customer experience and operational efficiency. The China Service Robotics Market indicates that the use of robots in hotels and restaurants has surged, with a projected growth rate of 25% annually. Robots are being utilized for tasks such as room service delivery, cleaning, and customer interaction. This trend is supported by the rising labor costs and the need for contactless services. Major hotel chains in China are investing in robotic solutions to streamline operations and provide unique experiences for guests. As the hospitality industry continues to evolve, the integration of robotics is expected to play a pivotal role in shaping its future.

Manufacturing Automation

Manufacturing automation remains a cornerstone of the China Service Robotics Market. The country is recognized as a global manufacturing hub, and the integration of robotics into production lines is essential for maintaining competitiveness. In 2025, the manufacturing sector accounted for nearly 40% of the service robotics market in China. The push for smart manufacturing, driven by initiatives such as 'Made in China 2025', emphasizes the need for advanced robotics to enhance productivity and reduce operational costs. As manufacturers increasingly adopt collaborative robots, the potential for innovation and efficiency gains in production processes is substantial, indicating a robust future for robotics in this sector.

Retail Robotics Integration

The integration of robotics in the retail sector is a significant driver for the China Service Robotics Market. Retailers are increasingly employing robots for inventory management, customer assistance, and checkout processes. In 2025, the retail robotics segment represented around 20% of the overall service robotics market in China. This growth is attributed to the rising demand for automation to enhance customer engagement and streamline operations. The Chinese government has also been supportive of technological advancements in retail, providing incentives for businesses to adopt robotic solutions. As consumer preferences shift towards more efficient and personalized shopping experiences, the role of robotics in retail is likely to expand further.

Healthcare Robotics Expansion

The China Service Robotics Market is experiencing a notable expansion in healthcare robotics. The increasing demand for automation in hospitals and clinics is driven by the need for efficiency and improved patient care. In 2025, the healthcare robotics segment accounted for approximately 30% of the total service robotics market in China, reflecting a growing trend towards robotic-assisted surgeries and rehabilitation. The Chinese government has been actively promoting the integration of robotics in healthcare through various policies and funding initiatives. This focus on healthcare robotics is likely to enhance operational efficiency, reduce human error, and improve patient outcomes, thereby solidifying the role of robotics in the healthcare sector.

Government Support and Policy Initiatives

Government support and policy initiatives are crucial drivers of the China Service Robotics Market. The Chinese government has implemented various policies aimed at promoting the development and adoption of robotics across multiple sectors. Initiatives such as the 'Robot Industry Development Plan' outline strategic goals for enhancing domestic robotics capabilities and fostering innovation. In 2025, government funding for robotics research and development reached significant levels, facilitating advancements in technology and manufacturing processes. This supportive environment is likely to encourage both domestic and foreign investments in the service robotics sector, further propelling market growth and establishing China as a leader in the global robotics landscape.