Rising Adoption of Smart Devices

The proliferation of smart devices in China is a primary driver for the China Internet Of Things IoT Insurance Market. As of 2025, it is estimated that over 1 billion smart devices are in use across the nation, creating a vast network of interconnected systems. This surge in smart technology adoption necessitates tailored insurance solutions to mitigate risks associated with device failures, data breaches, and cyber threats. Insurers are increasingly developing products that cater specifically to the unique challenges posed by IoT devices, thereby enhancing consumer confidence and encouraging further adoption. The integration of IoT in various sectors, including healthcare, transportation, and manufacturing, amplifies the demand for specialized insurance products, indicating a robust growth trajectory for the market.

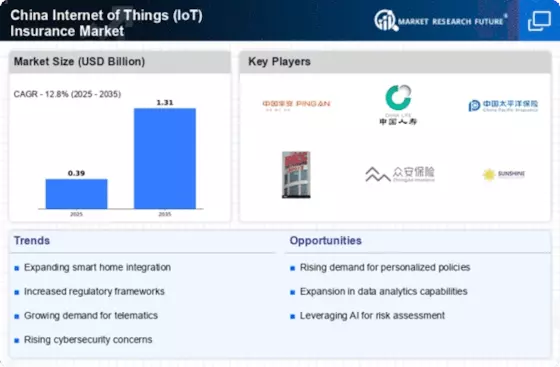

Integration of Advanced Analytics

The integration of advanced analytics and artificial intelligence into the insurance sector is transforming the China Internet Of Things IoT Insurance Market. Insurers are leveraging data collected from IoT devices to enhance risk assessment and underwriting processes. By utilizing predictive analytics, companies can better understand potential risks and tailor their insurance products accordingly. This data-driven approach not only improves the accuracy of pricing models but also enables insurers to offer personalized coverage options to clients. As more businesses adopt IoT technologies, the demand for sophisticated analytics in insurance is expected to grow, indicating a shift towards more informed decision-making in risk management and policy development.

Government Initiatives and Support

The Chinese government has been actively promoting the development of IoT technologies, which significantly influences the China Internet Of Things IoT Insurance Market. Initiatives such as the 'Made in China 2025' plan aim to position China as a global leader in IoT innovation. This governmental support includes funding for research and development, as well as the establishment of regulatory frameworks that encourage the growth of IoT applications. As a result, insurance companies are increasingly motivated to create products that align with these advancements, ensuring that businesses and consumers are adequately protected against potential risks. The government's focus on digital transformation and smart city initiatives further propels the demand for IoT insurance solutions, suggesting a favorable environment for market expansion.

Increased Awareness of Cyber Risks

As the number of connected devices in China continues to rise, so does the awareness of cyber risks associated with the Internet Of Things. The China Internet Of Things IoT Insurance Market is witnessing a growing demand for insurance products that address these vulnerabilities. Recent studies indicate that cyberattacks targeting IoT devices have increased by over 30% in the past year, prompting businesses to seek comprehensive coverage against potential breaches. Insurers are responding by developing policies that specifically cover IoT-related cyber risks, including data theft and system failures. This heightened awareness among consumers and businesses alike is likely to drive the market forward, as organizations recognize the necessity of protecting their digital assets in an increasingly interconnected world.

Growing Demand for Customized Insurance Solutions

The unique nature of IoT applications in various industries is driving the demand for customized insurance solutions within the China Internet Of Things IoT Insurance Market. Businesses are increasingly seeking insurance products that cater to their specific operational needs and risk profiles. For instance, manufacturers utilizing IoT for smart factories require coverage that addresses equipment malfunction and cyber threats, while healthcare providers need policies that protect patient data and device integrity. This trend towards customization is prompting insurers to innovate and develop niche products that align with the diverse requirements of different sectors. As the market evolves, the ability to offer tailored insurance solutions will likely become a key differentiator for insurers operating in the competitive landscape.