Growing Regulatory Requirements

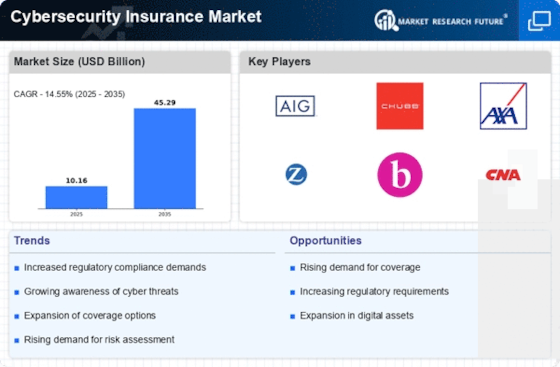

The Cybersecurity Insurance Market is significantly influenced by the increasing regulatory landscape surrounding data protection and cybersecurity. Governments and regulatory bodies are implementing stringent regulations that mandate organizations to adopt comprehensive cybersecurity measures. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose heavy penalties for non-compliance, thereby incentivizing businesses to invest in cybersecurity insurance. This regulatory pressure not only drives demand for insurance products but also encourages organizations to enhance their cybersecurity frameworks. Consequently, the Cybersecurity Insurance Market is likely to expand as companies seek to align with compliance requirements while safeguarding their assets against potential cyber threats.

Increasing Cyber Threat Landscape

The Cybersecurity Insurance Market is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Organizations are increasingly targeted by ransomware attacks, data breaches, and other malicious activities, prompting a heightened awareness of the need for robust cybersecurity measures. According to recent data, the number of reported cyber incidents has risen dramatically, with estimates suggesting that the global cost of cybercrime could reach trillions of dollars annually. This alarming trend compels businesses to seek cybersecurity insurance as a means of mitigating financial losses and ensuring business continuity. As a result, the Cybersecurity Insurance Market is poised for substantial growth, driven by the urgent need for protection against evolving cyber risks.

Rising Awareness of Cyber Risk Management

The Cybersecurity Insurance Market is benefiting from a growing awareness among businesses regarding the importance of cyber risk management. As organizations increasingly recognize that traditional insurance policies may not cover cyber-related incidents, there is a shift towards specialized cybersecurity insurance products. This awareness is further fueled by high-profile data breaches that have made headlines, highlighting the potential financial repercussions of inadequate cyber defenses. Research indicates that a significant percentage of businesses are now prioritizing cybersecurity in their risk management strategies, leading to a corresponding increase in the uptake of cybersecurity insurance. This trend suggests that the Cybersecurity Insurance Market will continue to thrive as more organizations seek to protect themselves against the financial fallout of cyber incidents.

Technological Advancements in Cybersecurity

The Cybersecurity Insurance Market is being propelled by rapid technological advancements in cybersecurity solutions. Innovations such as artificial intelligence, machine learning, and advanced threat detection systems are enhancing the ability of organizations to prevent and respond to cyber threats. As these technologies become more integrated into business operations, the demand for cybersecurity insurance is likely to rise. Companies are increasingly recognizing that investing in advanced cybersecurity measures not only reduces their risk exposure but also makes them more attractive to insurers. This symbiotic relationship between technology and insurance is fostering growth in the Cybersecurity Insurance Market, as businesses seek comprehensive coverage that aligns with their enhanced cybersecurity capabilities.

Expansion of Digital Transformation Initiatives

The Cybersecurity Insurance Market is experiencing growth due to the widespread adoption of digital transformation initiatives across various sectors. As organizations transition to digital platforms, they become more vulnerable to cyber threats, necessitating the need for cybersecurity insurance. The shift towards cloud computing, remote work, and digital transactions has created new attack surfaces for cybercriminals. Consequently, businesses are increasingly aware of the potential risks associated with digital operations and are seeking insurance solutions to mitigate these risks. Data suggests that the demand for cybersecurity insurance is likely to increase as more organizations embrace digital transformation, thereby driving the Cybersecurity Insurance Market forward.