Increased Cybersecurity Concerns

As the number of connected devices rises, so do the cybersecurity threats associated with them. The Germany Internet Of Things IoT Insurance Market is significantly influenced by the heightened awareness of cybersecurity risks. In 2025, reports indicated that cyberattacks targeting IoT devices had increased by 30% in Germany, prompting businesses and consumers to seek insurance products that provide coverage against such threats. Insurers are now focusing on developing policies that include cyber liability coverage, which protects against data breaches and other cyber incidents. This shift reflects a broader trend in the insurance industry, where the integration of cybersecurity measures into IoT insurance products is becoming essential to meet the evolving needs of policyholders.

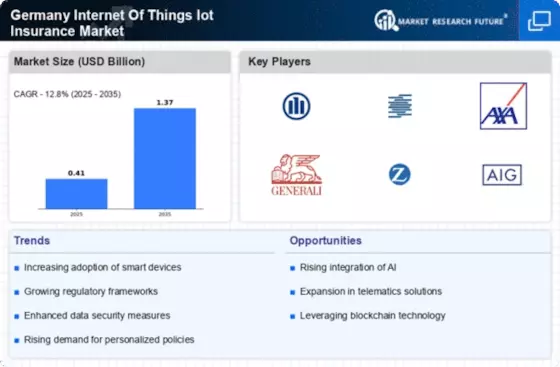

Growing Adoption of Smart Devices

The proliferation of smart devices in Germany is a primary driver for the Germany Internet Of Things IoT Insurance Market. As households and businesses increasingly integrate smart technologies, the need for insurance products that cover these devices becomes apparent. In 2025, it was estimated that over 70 million smart devices were in use across Germany, indicating a robust market for IoT insurance. This trend suggests that insurers must adapt their offerings to encompass risks associated with smart home technologies, wearables, and connected vehicles. The growing reliance on these devices not only enhances convenience but also raises concerns about data breaches and device malfunctions, thereby creating a demand for specialized insurance solutions that address these emerging risks.

Regulatory Compliance and Standards

The regulatory landscape in Germany is evolving to address the complexities introduced by IoT technologies. The Germany Internet Of Things IoT Insurance Market is driven by the need for compliance with data protection regulations, such as the General Data Protection Regulation (GDPR). Insurers are required to ensure that their products align with these regulations, which can influence policy design and pricing. In 2025, it was reported that 60% of German insurers were actively revising their IoT insurance offerings to comply with new regulatory standards. This regulatory pressure not only shapes the market but also encourages innovation in product development, as insurers seek to create solutions that meet both consumer needs and legal requirements.

Rising Demand for Customized Insurance Solutions

The unique nature of IoT devices necessitates tailored insurance solutions, which is a significant driver for the Germany Internet Of Things IoT Insurance Market. Consumers and businesses are increasingly looking for insurance products that specifically address the risks associated with their connected devices. In 2025, surveys indicated that 65% of German consumers preferred customized insurance policies over standard offerings. This trend suggests that insurers must invest in data analytics and customer insights to develop personalized products that cater to individual needs. By leveraging technology, insurers can create dynamic pricing models and coverage options that reflect the specific risks associated with various IoT applications, thereby enhancing customer satisfaction and loyalty.

Integration of Advanced Analytics in Underwriting

The integration of advanced analytics into the underwriting process is transforming the Germany Internet Of Things IoT Insurance Market. Insurers are increasingly utilizing data collected from IoT devices to assess risk more accurately and set premiums accordingly. In 2025, it was noted that 50% of insurers in Germany had adopted data analytics tools to enhance their underwriting processes. This shift allows for more precise risk evaluation, enabling insurers to offer competitive pricing and tailored coverage options. Furthermore, the use of predictive analytics can help insurers identify potential claims before they occur, thereby reducing losses and improving overall profitability. This trend indicates a move towards a more data-driven approach in the insurance sector, which is likely to shape the future of IoT insurance in Germany.