Growing Demand for Smart Devices

The proliferation of smart devices in Japan is a key driver for the Japan Internet Of Things IoT Insurance Market. As households and businesses increasingly adopt smart technologies, the need for insurance products that cover these devices becomes apparent. In 2025, it was estimated that over 80 million smart devices were in use across Japan, leading to a heightened awareness of potential risks associated with their operation. This growing demand for smart devices necessitates tailored insurance solutions that address specific vulnerabilities, such as cyber threats and device malfunctions. Consequently, insurers are developing innovative policies that cater to the unique needs of consumers and businesses, thereby expanding the market for IoT insurance in Japan.

Government Initiatives and Regulations

Government initiatives aimed at promoting the Internet of Things in Japan significantly influence the Japan Internet Of Things IoT Insurance Market. The Japanese government has implemented various policies to encourage the adoption of IoT technologies, including financial incentives and regulatory frameworks that support innovation. For instance, the Ministry of Internal Affairs and Communications has launched programs to enhance connectivity and data sharing among IoT devices. These initiatives not only foster technological advancement but also create a conducive environment for the development of IoT insurance products. As businesses and consumers increasingly engage with IoT technologies, the demand for insurance solutions that mitigate associated risks is likely to rise, further propelling market growth.

Rising Awareness of Cybersecurity Risks

As the number of connected devices increases, so does the awareness of cybersecurity risks among consumers and businesses in Japan. This heightened awareness is a significant driver for the Japan Internet Of Things IoT Insurance Market. In 2025, a survey indicated that over 60% of Japanese businesses recognized the potential financial impact of cyber threats on their operations. Consequently, there is a growing demand for insurance products that specifically address cybersecurity risks associated with IoT devices. Insurers are responding by developing comprehensive policies that cover data breaches, cyberattacks, and other related incidents. This trend not only protects consumers but also fosters trust in IoT technologies, further stimulating market growth.

Integration of Artificial Intelligence in Insurance

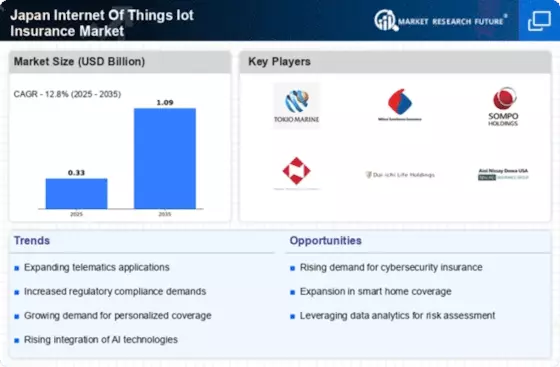

The integration of artificial intelligence (AI) into the insurance sector is transforming the Japan Internet Of Things IoT Insurance Market. AI technologies enable insurers to analyze vast amounts of data generated by IoT devices, leading to improved risk assessment and pricing strategies. In 2025, it was reported that AI-driven analytics could reduce claims processing time by up to 30%, enhancing customer satisfaction. This technological advancement allows insurers to offer more personalized and efficient services, thereby attracting a broader customer base. As AI continues to evolve, its application in IoT insurance is expected to deepen, creating new opportunities for innovation and growth within the market.

Increased Focus on Sustainability and Environmental Impact

The growing emphasis on sustainability and environmental impact in Japan is influencing the Japan Internet Of Things IoT Insurance Market. As businesses and consumers become more environmentally conscious, there is a rising demand for insurance products that support sustainable practices. IoT technologies can play a crucial role in monitoring and reducing environmental footprints, leading to the development of insurance solutions that incentivize eco-friendly behaviors. For instance, insurers may offer discounts for businesses that utilize IoT devices to track energy consumption and reduce waste. This alignment of insurance products with sustainability goals not only enhances market appeal but also encourages the adoption of IoT technologies, thereby driving growth in the insurance sector.