Rising Prevalence of Epilepsy

The increasing prevalence of epilepsy in China is a crucial driver for the epilepsy devices market. Recent estimates suggest that approximately 9 million individuals in China are affected by epilepsy, which translates to a prevalence rate of about 0.7% of the population. This growing patient base necessitates the development and adoption of advanced epilepsy devices, such as monitoring systems and seizure detection tools. As awareness of epilepsy improves, more patients seek effective management solutions, thereby propelling market growth. Furthermore, the rising incidence of neurological disorders, coupled with an aging population, is likely to further amplify the demand for innovative devices tailored to epilepsy management. Consequently, the epilepsy devices market is poised for expansion as healthcare providers and patients alike seek effective solutions to address this pressing health concern.

Rising Awareness and Education

The increasing awareness and education surrounding epilepsy in China significantly impact the epilepsy devices market. Public health campaigns and educational initiatives have been instrumental in reducing stigma and promoting understanding of the condition. As awareness grows, more individuals are likely to seek medical advice and treatment, leading to a higher demand for epilepsy devices. Furthermore, healthcare professionals are becoming more knowledgeable about the latest technologies available for managing epilepsy, which encourages the adoption of these devices in clinical practice. This heightened awareness not only drives market growth but also fosters a supportive environment for patients, ultimately contributing to improved health outcomes. The epilepsy devices market stands to benefit from this cultural shift towards greater understanding and acceptance of epilepsy.

Increased Healthcare Expenditure

China's rising healthcare expenditure is a significant driver for the epilepsy devices market. The government has been progressively increasing its healthcare budget, with expenditures reaching approximately 6.5% of GDP in recent years. This financial commitment facilitates the development and distribution of advanced medical devices, including those for epilepsy management. As healthcare funding expands, hospitals and clinics are more likely to invest in state-of-the-art epilepsy devices, enhancing patient care and treatment options. Moreover, the growing emphasis on preventive healthcare and early diagnosis further supports the market, as more resources are allocated to innovative technologies that can improve the quality of life for individuals with epilepsy. Thus, the upward trend in healthcare spending is likely to bolster the epilepsy devices market in China.

Government Regulations and Policies

Government regulations and policies in China are crucial drivers of the epilepsy devices market. The Chinese government has implemented various policies aimed at improving healthcare access and quality, which includes the regulation of medical devices. Stringent approval processes and quality standards ensure that only safe and effective devices reach the market, thereby enhancing consumer confidence. Additionally, the government has been promoting the use of innovative medical technologies through subsidies and grants, which can lower the financial barriers for manufacturers and consumers alike. As a result, the regulatory landscape is becoming increasingly favorable for the development and commercialization of epilepsy devices. This supportive environment is likely to stimulate market growth, as companies are encouraged to invest in research and development to bring new and improved products to the epilepsy devices market.

Technological Innovations in Device Development

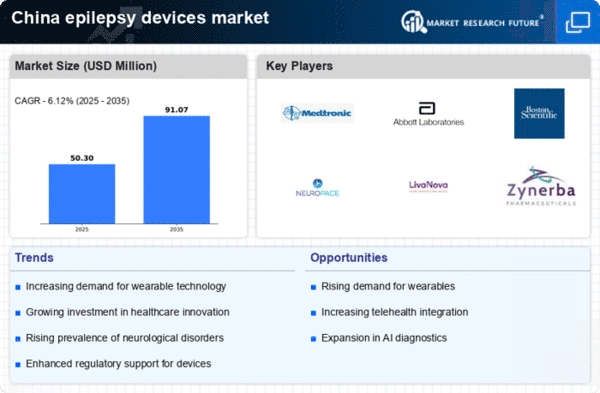

Technological advancements play a pivotal role in shaping the epilepsy devices market. Innovations such as wearable devices, mobile applications, and implantable technologies are revolutionizing how epilepsy is monitored and managed. For instance, the integration of artificial intelligence and machine learning into these devices enhances their ability to predict seizures, providing patients with timely alerts. In China, the market for wearable health technology is projected to grow significantly, with estimates indicating a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in technological innovation not only improves patient outcomes but also attracts investment from both public and private sectors, thereby fostering a conducive environment for the growth of the epilepsy devices market.