Rising Prevalence of Epilepsy

The increasing prevalence of epilepsy in France is a crucial driver for the epilepsy devices market. Recent estimates suggest that approximately 600,000 individuals in France are affected by epilepsy, which translates to about 1% of the population. This growing patient base necessitates the development and adoption of advanced epilepsy devices, such as seizure detection monitors and neurostimulation devices. As awareness of epilepsy rises, healthcare providers are more likely to recommend these devices, thereby expanding the market. Furthermore, the aging population in France, which is more susceptible to neurological disorders, is likely to contribute to the demand for innovative solutions in the epilepsy devices market.

Growing Awareness and Education

The growing awareness and education surrounding epilepsy in France are vital for the epilepsy devices market. Campaigns aimed at reducing stigma and promoting understanding of epilepsy have gained momentum, leading to increased public knowledge. This heightened awareness encourages patients to seek medical advice and explore available treatment options, including advanced devices. Educational initiatives by non-profit organizations and healthcare providers are likely to result in a more informed patient population, which may lead to higher adoption rates of epilepsy devices. Consequently, the epilepsy devices market is expected to benefit from this trend as more individuals become aware of the benefits of these technologies.

Regulatory Support for Innovation

Regulatory support for innovation in medical devices is a key driver for the epilepsy devices market. In France, the regulatory framework encourages the development and approval of new medical technologies, including those for epilepsy management. The French National Agency for the Safety of Medicines and Health Products (ANSM) plays a crucial role in ensuring that new devices meet safety and efficacy standards. This supportive environment fosters innovation, allowing manufacturers to bring cutting-edge epilepsy devices to market more efficiently. As a result, the epilepsy devices market is likely to experience growth, driven by a favorable regulatory landscape that promotes the introduction of novel solutions.

Advancements in Medical Technology

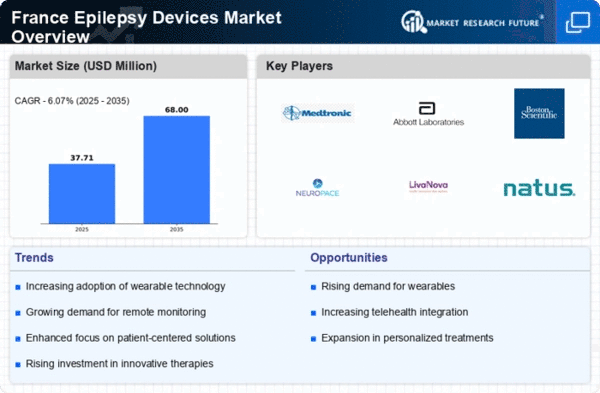

Technological advancements play a pivotal role in shaping the epilepsy devices market. Innovations in wearable technology, such as smartwatches and portable EEG devices, have enhanced the ability to monitor seizures in real-time. These devices are increasingly integrated with mobile applications, allowing for better data collection and analysis. In France, the market for wearable medical devices is projected to grow at a CAGR of around 15% over the next five years. This growth is indicative of the increasing reliance on technology to manage epilepsy, thus driving the demand for more sophisticated devices in the epilepsy devices market.

Increased Investment in Healthcare

Investment in healthcare infrastructure in France is another significant driver for the epilepsy devices market. The French government has committed to enhancing healthcare services, which includes funding for medical research and the development of new technologies. In 2025, healthcare spending in France is expected to reach approximately €300 billion, with a portion allocated to neurological disorders. This financial support is likely to facilitate the introduction of innovative epilepsy devices, making them more accessible to patients. As a result, the epilepsy devices market is poised for growth, driven by increased funding and resources dedicated to improving patient outcomes.