Rising Incidence of Epilepsy

The increasing prevalence of epilepsy in South Korea is a crucial driver for the epilepsy devices market. Recent statistics indicate that approximately 0.5-1% of the population is affected by epilepsy, leading to a growing demand for effective management solutions. This rise in incidence necessitates the development and adoption of advanced devices that can assist in monitoring and controlling seizures. As the population ages, the incidence of epilepsy is expected to rise further, thereby propelling the market forward. The need for innovative devices that can provide real-time data and improve patient outcomes is becoming more pronounced, suggesting a robust growth trajectory for the epilepsy devices market in the coming years.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in South Korea are playing a pivotal role in the epilepsy devices market. Increased funding for research and development of medical devices is evident, with the government allocating substantial resources to support innovation in epilepsy care. This financial backing encourages companies to develop cutting-edge devices that can enhance patient outcomes. Furthermore, public health campaigns aimed at raising awareness about epilepsy are likely to drive demand for effective management solutions. As a result, the epilepsy devices market is expected to benefit from these supportive measures, fostering growth and innovation.

Technological Integration in Healthcare

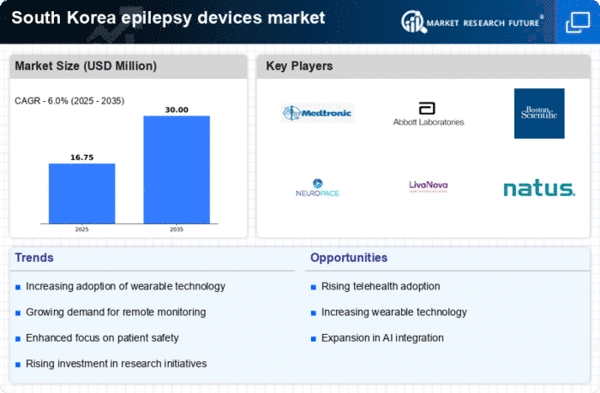

The integration of advanced technologies into healthcare systems in South Korea is significantly influencing the epilepsy devices market. The adoption of telemedicine, wearable devices, and mobile health applications is on the rise, facilitating better patient monitoring and management. For instance, wearable devices that track seizure activity and provide alerts to caregivers are gaining traction. This technological shift not only enhances patient care but also encourages healthcare providers to invest in innovative epilepsy management solutions. The market is projected to grow as these technologies become more accessible and affordable, indicating a promising future for the epilepsy devices market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine in South Korea is emerging as a significant driver for the epilepsy devices market. Patients are increasingly seeking tailored treatment options that cater to their specific needs, which is prompting manufacturers to develop devices that offer customizable features. This trend is supported by advancements in genetic research and data analytics, enabling healthcare providers to offer more precise treatment plans. As the demand for personalized solutions continues to rise, the epilepsy devices market is likely to expand, with companies focusing on creating devices that align with individual patient profiles.

Increased Investment in Research and Development

Investment in research and development (R&D) within the medical device sector is a critical driver for the epilepsy devices market. South Korea has seen a surge in funding directed towards the development of innovative epilepsy management solutions. This investment is fostering collaboration between academic institutions and industry players, leading to the creation of advanced devices that improve patient care. The focus on R&D is expected to yield new technologies that enhance the efficacy of epilepsy treatments, thereby driving market growth. As companies continue to innovate, the epilepsy devices market is poised for significant advancements in the near future.