Growing Demand for Industrial Automation

The push for industrial automation in China is a key driver of the digital inspection market. As manufacturers seek to optimize production processes and reduce operational costs, the adoption of automated inspection systems is becoming more prevalent. This trend is particularly evident in sectors such as automotive and electronics, where precision and efficiency are paramount. The digital inspection market is expected to witness a growth rate of around 12% annually, fueled by the increasing integration of automation technologies. This shift not only enhances productivity but also minimizes human error, thereby reinforcing the importance of digital inspection solutions in modern manufacturing environments.

Rising Focus on Sustainability Practices

Sustainability is becoming a central theme in various industries across China, influencing the digital inspection market. Companies are increasingly adopting eco-friendly practices, which necessitate the use of digital inspection technologies to monitor and reduce environmental impact. For example, industries are utilizing digital tools to ensure compliance with environmental regulations and to track resource usage effectively. This growing emphasis on sustainability is likely to propel the digital inspection market, as organizations seek to implement practices that align with environmental goals. The market could potentially expand by 10% annually as businesses recognize the value of integrating sustainability into their operational frameworks.

Regulatory Compliance and Quality Assurance

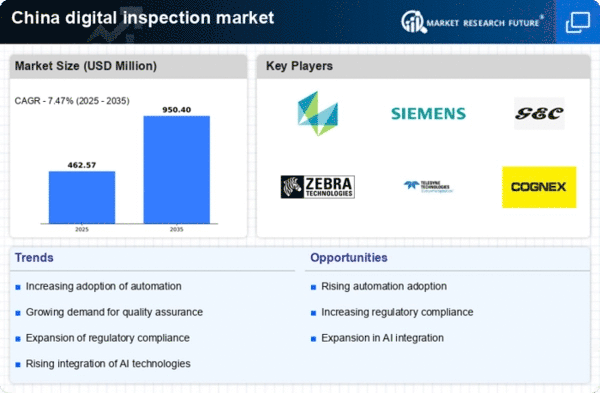

In China, the digital inspection market is significantly influenced by stringent regulatory compliance and quality assurance requirements. Industries such as food and pharmaceuticals are mandated to adhere to rigorous standards, necessitating the use of digital inspection technologies to ensure compliance. The market is projected to reach a value of $2 billion by 2026, as companies invest in digital solutions to meet these regulatory demands. This trend indicates a growing recognition of the importance of quality assurance in maintaining consumer trust and safety. Consequently, the digital inspection market is likely to see increased adoption of technologies that facilitate compliance and enhance overall product quality.

Technological Advancements in Inspection Tools

The digital inspection market in China is experiencing a surge due to rapid technological advancements in inspection tools. Innovations such as high-resolution imaging, drones, and automated inspection systems are enhancing the efficiency and accuracy of inspections across various sectors. For instance, the integration of advanced sensors and imaging technologies allows for real-time data collection and analysis, which is crucial for industries like manufacturing and construction. The market is projected to grow at a CAGR of approximately 15% from 2025 to 2030, driven by these technological improvements. As companies increasingly adopt these tools, the digital inspection market is likely to expand significantly, reflecting a shift towards more sophisticated inspection methodologies.

Increased Investment in Infrastructure Development

China's ongoing investment in infrastructure development is a significant driver of the digital inspection market. The government has allocated substantial funds towards enhancing transportation, energy, and urban infrastructure, which necessitates rigorous inspection processes. The digital inspection market is projected to benefit from this trend, with an expected growth of 14% over the next five years. As infrastructure projects become more complex, the demand for advanced inspection technologies that ensure safety and compliance is likely to rise. This investment not only supports economic growth but also highlights the critical role of digital inspection in maintaining the integrity of large-scale infrastructure projects.