Expansion of Biotechnology Research

The biotechnology sector in China is undergoing rapid expansion, which seems to significantly influence the chromatography columns market. With the government's emphasis on innovation and research, biotechnology firms are increasingly investing in advanced analytical techniques. In 2025, the biotechnology market in China is expected to surpass $100 billion, highlighting the sector's growth potential. Chromatography columns play a crucial role in various biotechnological applications, including protein purification and metabolomics. As research activities intensify, the demand for high-performance chromatography systems is likely to increase, driving market growth. Furthermore, the collaboration between academic institutions and biotechnology companies fosters innovation, leading to the development of novel chromatography technologies. This synergy is expected to enhance the capabilities of chromatography columns, thereby further stimulating the market in China.

Growing Investment in Quality Control

The increasing investment in quality control across various industries in China appears to be a significant driver for the chromatography columns market. As companies strive to meet international quality standards, the demand for reliable analytical techniques is on the rise. The food and beverage sector, in particular, is witnessing heightened scrutiny regarding product safety and quality, leading to a greater reliance on chromatography for testing. In 2025, the food safety testing market in China is projected to exceed $10 billion, indicating a robust demand for chromatography solutions. This trend is likely to encourage manufacturers to enhance their chromatography offerings, ensuring they meet the evolving needs of quality control. As a result, the chromatography columns market is expected to benefit from the growing emphasis on quality assurance and regulatory compliance across various sectors in China.

Rising Demand in Pharmaceutical Sector

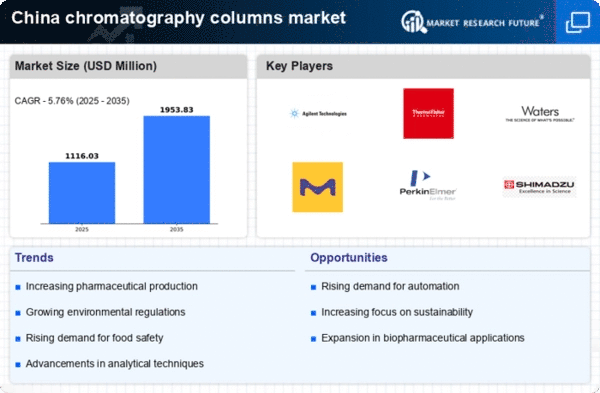

The pharmaceutical sector in China is experiencing a notable surge, which appears to be a primary driver for the chromatography columns market. As the industry expands, the need for efficient separation and analysis techniques becomes increasingly critical. In 2025, the pharmaceutical market in China is projected to reach approximately $150 billion, indicating a robust growth trajectory. This growth necessitates advanced chromatography solutions to ensure quality control and compliance with stringent regulations. Consequently, manufacturers of chromatography columns are likely to benefit from this rising demand, as they provide essential tools for drug development and quality assurance processes. The increasing complexity of drug formulations further emphasizes the need for sophisticated chromatography techniques, thereby propelling the market forward. As a result, the chromatography columns market is poised to thrive in tandem with the pharmaceutical industry's expansion in China.

Increased Focus on Environmental Testing

There is a growing emphasis on environmental testing in China, which appears to be a significant driver for the chromatography columns market. As environmental regulations become more stringent, industries are compelled to adopt advanced analytical methods to monitor pollutants and ensure compliance. The environmental testing market in China is projected to grow at a CAGR of approximately 8% through 2025, indicating a rising need for effective separation techniques. Chromatography columns are essential for analyzing complex environmental samples, such as water and soil, for contaminants. This increasing focus on environmental sustainability is likely to drive demand for chromatography solutions that can provide accurate and reliable results. Consequently, the chromatography columns market is expected to benefit from the heightened awareness and regulatory requirements surrounding environmental protection in China.

Technological Innovations in Chromatography

Technological innovations in chromatography are likely to serve as a catalyst for the chromatography columns market in China. The introduction of advanced materials and techniques, such as ultra-high-performance liquid chromatography (UHPLC) and supercritical fluid chromatography (SFC), appears to enhance the efficiency and effectiveness of separation processes. These innovations enable laboratories to achieve higher resolution and faster analysis times, which are critical in various applications, including pharmaceuticals and food safety. As the demand for rapid and accurate analytical results increases, the adoption of these advanced chromatography technologies is expected to rise. In 2025, the market for chromatography instruments in China is anticipated to reach approximately $2 billion, reflecting the impact of these technological advancements. Thus, the chromatography columns market is poised for growth as laboratories seek to leverage these innovations to improve their analytical capabilities.