Market Trends and Projections

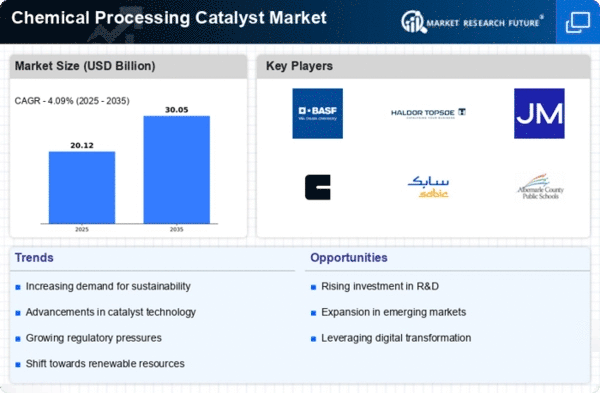

The Global Chemical Processing Catalyst Market Industry is characterized by various trends and projections that indicate its future trajectory. The market is expected to reach 19.3 USD Billion in 2024, with a projected growth to 30.1 USD Billion by 2035. The compound annual growth rate during the period from 2025 to 2035 is estimated at 4.09%. These figures reflect the increasing importance of catalysts in enhancing process efficiency and sustainability across multiple sectors. The market dynamics are influenced by technological advancements, regulatory pressures, and the ongoing shift towards greener chemical processes.

Growth in the Petrochemical Sector

The Global Chemical Processing Catalyst Market Industry is significantly influenced by the growth of the petrochemical sector. As global energy demands rise, the petrochemical industry is expanding, necessitating efficient catalysts for various processes, including cracking and reforming. This sector's growth is reflected in the increasing investments in refining capacities and the development of new petrochemical plants. The market is anticipated to experience a compound annual growth rate of 4.09% from 2025 to 2035, driven by the need for catalysts that enhance yield and reduce operational costs. The synergy between catalyst technology and petrochemical production is likely to bolster market dynamics.

Rising Demand for Sustainable Solutions

The Global Chemical Processing Catalyst Market Industry is witnessing an increasing demand for sustainable and environmentally friendly solutions. This trend is driven by stringent regulations aimed at reducing carbon emissions and enhancing energy efficiency. For instance, catalysts that facilitate greener processes are becoming essential in various sectors, including petrochemicals and pharmaceuticals. As industries strive to meet sustainability goals, the market is projected to reach 19.3 USD Billion in 2024, reflecting a growing emphasis on eco-friendly technologies. The shift towards sustainable practices not only aligns with regulatory requirements but also appeals to consumers who are increasingly conscious of environmental impacts.

Technological Advancements in Catalysis

Technological advancements play a pivotal role in shaping the Global Chemical Processing Catalyst Market Industry. Innovations in catalyst design and synthesis are enhancing efficiency and selectivity in chemical processes. For example, the development of nanostructured catalysts is enabling more effective reactions at lower temperatures, thereby reducing energy consumption. These advancements are likely to drive market growth, with projections indicating a rise to 30.1 USD Billion by 2035. As industries adopt cutting-edge technologies, the demand for advanced catalysts is expected to surge, fostering a competitive landscape that prioritizes innovation and performance.

Increasing Focus on Process Optimization

Process optimization remains a critical driver in the Global Chemical Processing Catalyst Market Industry. Industries are increasingly seeking catalysts that not only improve reaction rates but also enhance overall process efficiency. This focus on optimization is evident in sectors such as fine chemicals and specialty chemicals, where the demand for high-performance catalysts is rising. Companies are investing in research and development to create catalysts that minimize waste and energy consumption. As a result, the market is expected to grow steadily, reflecting the industry's commitment to achieving operational excellence and sustainability through advanced catalytic solutions.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are paramount in the Global Chemical Processing Catalyst Market Industry. Governments worldwide are implementing stringent regulations to ensure safe chemical processing and minimize environmental impacts. This regulatory landscape compels companies to adopt advanced catalysts that meet safety and environmental standards. For instance, catalysts that reduce hazardous emissions are increasingly mandated in various jurisdictions. As industries adapt to these regulations, the demand for compliant catalysts is likely to rise, contributing to market growth. The emphasis on safety and compliance not only protects public health but also enhances the reputation of companies committed to responsible practices.