Emergence of 5G Technology

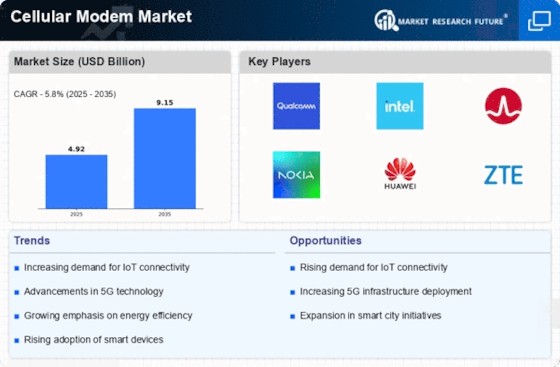

The advent of 5G technology is poised to revolutionize the Cellular Modem Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable a new wave of applications and services that require high-performance connectivity. The deployment of 5G networks is already underway in various regions, with projections indicating that there will be over 1.5 billion 5G subscriptions by 2025. This technological advancement necessitates the development of compatible cellular modems that can leverage the capabilities of 5G networks. As a result, the Cellular Modem Market is likely to experience significant growth as manufacturers invest in research and development to create next-generation modems that meet the demands of 5G connectivity.

Expansion of Smart City Initiatives

The Cellular Modem Market is significantly influenced by the expansion of smart city initiatives. Governments and municipalities are increasingly investing in infrastructure that supports smart technologies, which rely heavily on cellular connectivity. For instance, the integration of smart traffic management systems, public safety networks, and environmental monitoring solutions necessitates reliable cellular modems. As cities aim to enhance operational efficiency and improve the quality of life for residents, the demand for advanced cellular modems is expected to rise. This trend is reflected in the projected growth of the smart city market, which is anticipated to reach USD 2.5 trillion by 2025. Thus, the Cellular Modem Market stands to benefit from these investments in urban infrastructure.

Rising Adoption of M2M Communication

The increasing adoption of machine-to-machine (M2M) communication is a key driver for the Cellular Modem Market. M2M technology facilitates seamless communication between devices, enabling automation and data exchange across various sectors, including manufacturing, healthcare, and transportation. The market for M2M connections is projected to grow exponentially, with estimates suggesting that there will be over 1 billion M2M connections by 2025. This growth is likely to spur demand for specialized cellular modems that can support M2M applications, such as telemetry and remote monitoring. As industries continue to embrace digital transformation, the Cellular Modem Market is expected to thrive, driven by the need for reliable and efficient communication solutions.

Growth of Remote Work and Telecommuting

The shift towards remote work and telecommuting has a profound impact on the Cellular Modem Market. As organizations adapt to flexible work arrangements, the need for reliable internet connectivity becomes increasingly critical. Cellular modems provide a viable solution for employees working from home or in remote locations, ensuring they remain connected to corporate networks. Recent statistics indicate that approximately 30% of the workforce is now engaged in remote work, a trend that is likely to persist. This shift not only drives demand for cellular modems but also encourages innovation in mobile connectivity solutions. Consequently, the Cellular Modem Market is expected to witness sustained growth as it caters to the evolving needs of a remote workforce.

Increased Demand for High-Speed Internet

The Cellular Modem Market experiences a surge in demand for high-speed internet connectivity. As consumers and businesses increasingly rely on data-intensive applications, the need for robust cellular modems becomes paramount. According to recent data, the number of mobile broadband subscriptions has reached over 5 billion, indicating a growing reliance on cellular technology. This trend is likely to drive innovation in modem technology, as manufacturers strive to meet the expectations for faster and more reliable connections. The proliferation of smart devices further amplifies this demand, as each device requires a stable internet connection to function optimally. Consequently, the Cellular Modem Market is poised for substantial growth as it adapts to these evolving consumer needs.