Legacy System Integration

The ISDN Modem Market is significantly influenced by the need for legacy system integration. Many organizations still rely on older communication systems that utilize ISDN technology. As these businesses upgrade their infrastructure, they often require ISDN modems to ensure compatibility with existing systems. This integration is crucial for maintaining operational continuity and minimizing disruptions during transitions. The market data indicates that a substantial portion of ISDN modem sales is attributed to organizations seeking to bridge the gap between outdated technology and modern communication solutions. Consequently, the demand for ISDN modems remains robust as companies navigate the complexities of technological upgrades.

Increased Focus on Data Security

In the ISDN Modem Market, there is a growing emphasis on data security and privacy. As cyber threats become more sophisticated, organizations are prioritizing secure communication channels. ISDN modems are often viewed as a secure option due to their dedicated lines, which can reduce the risk of interception compared to traditional broadband connections. This heightened focus on security is driving demand for ISDN modems, particularly in sectors that handle sensitive information, such as government and finance. Market analysis suggests that the security features inherent in ISDN technology may lead to a resurgence in its adoption, as businesses seek to safeguard their data against potential breaches.

Regulatory Compliance Requirements

The ISDN Modem Market is also shaped by regulatory compliance requirements that necessitate secure and reliable communication methods. Various industries are subject to stringent regulations regarding data transmission and privacy, which can influence the choice of communication technology. ISDN modems, with their established protocols and reliability, are often favored in sectors such as telecommunications and healthcare. Compliance with these regulations can drive organizations to invest in ISDN modems to ensure they meet legal standards. Market data indicates that the increasing complexity of regulatory frameworks is likely to sustain demand for ISDN modems, as companies strive to adhere to compliance mandates.

Rising Demand for Reliable Connectivity

The ISDN Modem Market is experiencing a notable increase in demand for reliable and stable connectivity solutions. As businesses and individuals seek uninterrupted internet access, ISDN modems are perceived as a viable option due to their ability to provide consistent data transmission. This demand is particularly pronounced in sectors such as finance and healthcare, where data integrity is paramount. According to recent data, the market for ISDN modems is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This growth is driven by the need for dependable communication channels, which ISDN modems can effectively deliver, thereby reinforcing their relevance in the current technological landscape.

Emerging Markets and Infrastructure Development

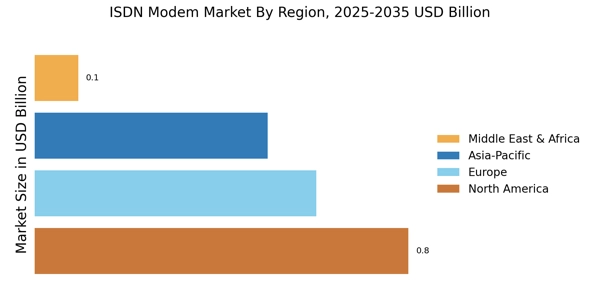

The ISDN Modem Market is witnessing growth in emerging markets, where infrastructure development is a key driver. As countries invest in expanding their telecommunications networks, the demand for reliable communication solutions, including ISDN modems, is expected to rise. These markets often require robust communication systems to support economic growth and connectivity. The data suggests that regions with developing infrastructure are likely to see a surge in ISDN modem adoption as businesses and governments seek to establish reliable communication channels. This trend indicates a potential for significant market expansion in areas where traditional broadband may not yet be fully established.