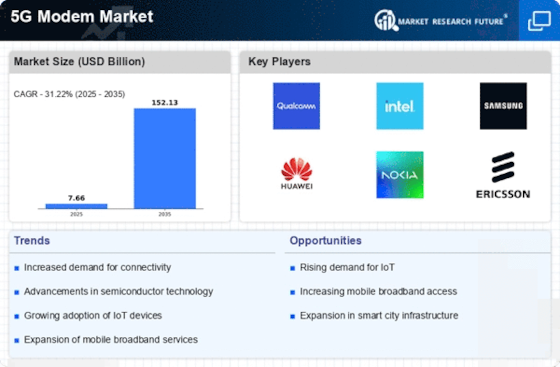

Expansion of Smart Cities

The development of smart cities is significantly influencing the 5G Modem Market. As urban areas evolve to incorporate advanced technologies, the demand for reliable and fast connectivity becomes paramount. Smart city initiatives often rely on 5G networks to facilitate real-time data exchange among various systems, such as traffic management and public safety. This integration is expected to drive the adoption of 5G modems, as they are essential for enabling seamless communication between devices. The 5G Modem Market is thus poised for growth, as municipalities invest in infrastructure to support these innovative urban environments.

Increased Data Consumption

The 5G Modem Market is experiencing a surge in demand driven by the exponential growth in data consumption. As more devices become interconnected, the need for high-speed internet access has intensified. Reports indicate that mobile data traffic is projected to reach 77 exabytes per month by 2025, necessitating advanced modem technologies. This trend is compelling manufacturers to innovate and enhance their offerings, ensuring that modems can support higher bandwidths and lower latency. Consequently, the 5G Modem Market is likely to witness substantial growth as consumers and businesses alike seek solutions that can accommodate their increasing data needs.

Emergence of Edge Computing

The rise of edge computing is influencing the 5G Modem Market by necessitating low-latency connections for data processing. As more applications move closer to the data source, the demand for 5G technology becomes critical. Edge computing enables faster data processing and reduces the load on central servers, which is essential for applications such as real-time analytics and IoT devices. The 5G Modem Market is expected to see growth as businesses seek to implement edge computing solutions that require high-speed, reliable connectivity. This trend indicates a shift towards more decentralized computing architectures, further driving the adoption of 5G modems.

Advancements in Automotive Technology

The automotive sector is undergoing a transformation with the advent of connected and autonomous vehicles, which is impacting the 5G Modem Market. These vehicles require robust communication systems to operate effectively, relying on 5G technology for real-time data exchange. The market for connected cars is anticipated to grow significantly, with estimates suggesting that by 2025, over 75 million connected vehicles will be on the roads. This trend is likely to drive demand for 5G modems, as automotive manufacturers seek to integrate advanced connectivity solutions into their vehicles, thereby enhancing safety and user experience.

Growth of Remote Work and Telecommuting

The shift towards remote work and telecommuting is reshaping the 5G Modem Market. As organizations adapt to flexible work arrangements, the demand for reliable and high-speed internet connections has surged. Employees require seamless connectivity to perform their tasks efficiently, which has led to an increased interest in 5G technology. The 5G Modem Market is likely to benefit from this trend, as businesses invest in infrastructure that supports remote work capabilities. This shift not only enhances productivity but also drives the need for advanced modem solutions that can cater to the evolving work environment.