Casino Size

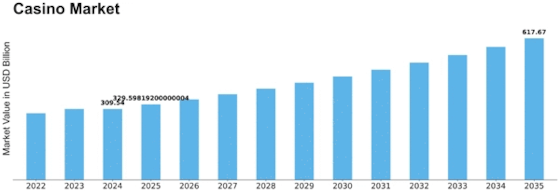

Casino Market Growth Projections and Opportunities

Numerous elements impact the casino market, which together define its dynamics and decide its overall success. The overall state of the economy is one of the main variables influencing the casino industry. The state of the economy, which encompasses variables like job rates, disposable income, and consumer confidence, is a major influence on how much money people are willing to spend on recreational activities like casino gambling. People typically have more money available to them during prosperous economic times, which encourages them to spend more on games and entertainment. On the other hand, consumer spending may decline during economic downturns, which may have an effect on the earnings of the casino sector. Another important aspect driving the casino sector is regulation. The sector is governed by a complicated network of laws that differ greatly between jurisdictions. The legality or prohibition of gambling, licensing standards, and tax laws all have an impact on how casinos run and compete in the industry. Modifications to regulatory frameworks may have a significant effect on market dynamics, influencing the introduction of new firms, the development of current operators, and the extension of the market as a whole. Technological developments are revolutionizing the casino industry and have a significant impact on its future.

The growth of mobile and internet casinos has allowed the business to go beyond conventional physical locations. Technological innovations like blockchain, artificial intelligence, and virtual and augmented reality are also making an impact. These technologies provide new gaming experiences while resolving issues with security and fairness. Casinos that adopt new technologies frequently find themselves at the forefront of the competitiveness of their business. The tastes and actions of consumers have a major role in determining the casino market. Over time, the features, game selections, and general casino experiences that appeal to patrons change. There has been a movement in the sector towards a more experience approach, where casinos are investing in non-gaming attractions including gourmet dining, luxury lodgings, and entertainment acts.

Furthermore, operators are putting policies in place to address issues associated to compulsive gambling, and there is an increasing focus on responsible gaming. For casinos to stay relevant and appealing to their target demographic, they must comprehend these changing tastes and make necessary adjustments. Share positioning tactics are essential for operators hoping to take a sizable chunk of the market and set themselves apart from rivals in the fiercely competitive casino industry. Concentrating on the variety of gaming products is one important tactic. Casinos looking to increase their market share frequently make investments in a variety of games, including more recent, cutting-edge possibilities as well as time-honored staples like table games and slots. This approach seeks to appeal to a wide range of gamers, drawing in both seasoned veterans and those looking for interesting and novel gaming experiences. In the casino industry, customer loyalty programs are essential to market share positioning. Operators understand how important it is to keep their current clientele and encourage them to come back. Incentives, prizes, and special benefits are usually given by loyalty programs to loyal participants in an effort to make them feel valued and appreciated. Casinos may gain repeat business and positive word-of-mouth marketing from pleased players who tell others about their great experiences when they cultivate a loyal client base.

Casinos utilize strategic alliances and cooperation as an additional tactic to increase their market share. Through strategic partnerships with hotels, companies, and other entertainment venues, casinos are able to deliver all-inclusive packages that go beyond gaming. These collaborations might take the form of cooperative marketing campaigns, collaborative events, or cross-promotions, generating synergies that bolster the casino's market position and draw in a larger audience. Investing in state-of-the-art technology allows casinos to maintain their leadership position in the business. Operators may differentiate themselves from competitors by embracing innovations like mobile gaming, virtual and augmented reality, and creative payment methods. Casinos that offer a smooth, cutting-edge gaming experience stand to gain from players who are tech aware and establish themselves as industry leaders in an increasingly digital environment. Casinos frequently use geographic expansion as a tactic to gain market share. This might entail developing new physical sites in unexplored markets or extending the reach of internet platforms to a worldwide audience. In order to gain market share and spur revenue development, casinos can deliberately position themselves as major players in developing markets by choosing areas with strong demand and little competition.

Leave a Comment