Regulatory Compliance

The Global Cargo Inspection Market Industry is significantly influenced by stringent regulatory frameworks imposed by governments worldwide. Compliance with international standards and regulations is crucial for businesses engaged in cargo transportation. Governments are increasingly mandating thorough inspections to prevent the entry of hazardous materials and ensure public safety. This regulatory environment compels companies to invest in comprehensive inspection services, thereby driving market growth. The projected CAGR of 3.8% from 2025 to 2035 indicates that adherence to evolving regulations will continue to shape the landscape of cargo inspection, fostering a culture of safety and compliance.

Rising Security Concerns

Growing security concerns related to terrorism and smuggling are propelling the Global Cargo Inspection Market Industry forward. As global threats evolve, authorities are prioritizing the inspection of cargo to prevent illegal activities. Enhanced security measures at ports and borders necessitate rigorous inspection protocols, thereby increasing demand for inspection services. This trend is evident as governments allocate more resources to bolster security infrastructure. The market's growth trajectory suggests that addressing security challenges through effective cargo inspection will remain a priority, influencing investment decisions and operational strategies in the coming years.

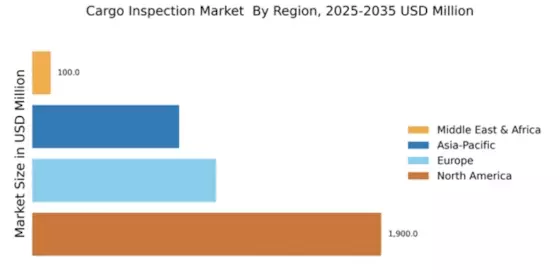

Market Growth Projections

The Global Cargo Inspection Market Industry is poised for substantial growth, with projections indicating a rise from 3.8 USD Billion in 2024 to 5.73 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.8% from 2025 to 2035. Factors such as increasing trade activities, technological advancements, and heightened security concerns are driving this expansion. The market's evolution suggests a dynamic landscape where stakeholders must adapt to changing regulations and emerging technologies to remain competitive. As the industry progresses, the focus on efficient and effective cargo inspection will be paramount.

Technological Advancements

Technological innovations are transforming the Global Cargo Inspection Market Industry, enhancing the efficiency and accuracy of inspection processes. The integration of advanced technologies such as artificial intelligence, machine learning, and automated scanning systems is streamlining cargo inspections. These technologies not only reduce inspection times but also improve detection rates for illicit goods. As a result, stakeholders are increasingly investing in these technologies to comply with stringent regulations. The anticipated growth of the market to 5.73 USD Billion by 2035 underscores the importance of technology in driving operational efficiencies and ensuring cargo security.

Increasing Trade Activities

The Global Cargo Inspection Market Industry is experiencing growth due to the rise in international trade activities. As countries engage in more cross-border transactions, the need for effective cargo inspection becomes paramount to ensure compliance with safety and regulatory standards. In 2024, the market is valued at approximately 3.8 USD Billion, reflecting the increasing demand for inspection services. This trend is likely to continue as trade volumes expand, necessitating robust inspection protocols to mitigate risks associated with smuggling and contraband. The focus on enhancing trade facilitation through efficient cargo inspection processes is expected to drive market growth significantly.

Environmental Sustainability Initiatives

The Global Cargo Inspection Market Industry is increasingly aligned with environmental sustainability initiatives. As global awareness of environmental issues rises, regulatory bodies are enforcing stricter guidelines on the transportation of hazardous materials. Companies are compelled to adopt eco-friendly practices, which include thorough inspections to ensure compliance with environmental regulations. This shift towards sustainability is likely to drive investments in advanced inspection technologies that minimize environmental impact. The market's growth, projected to reach 5.73 USD Billion by 2035, indicates that sustainability will play a crucial role in shaping the future of cargo inspection, influencing both operational practices and regulatory frameworks.