Regulatory Support for Medical Innovations

Regulatory support for medical innovations plays a vital role in shaping the Cardiovascular Needle Market. Regulatory bodies are increasingly streamlining approval processes for new medical devices, encouraging manufacturers to develop innovative needle technologies. This supportive environment fosters competition and drives advancements in needle design and functionality. Market data indicates that as regulations become more favorable, the introduction of novel cardiovascular needles is likely to accelerate. This trend suggests that the Cardiovascular Needle Market will continue to thrive, as regulatory frameworks adapt to support the ongoing evolution of medical technologies.

Technological Innovations in Needle Design

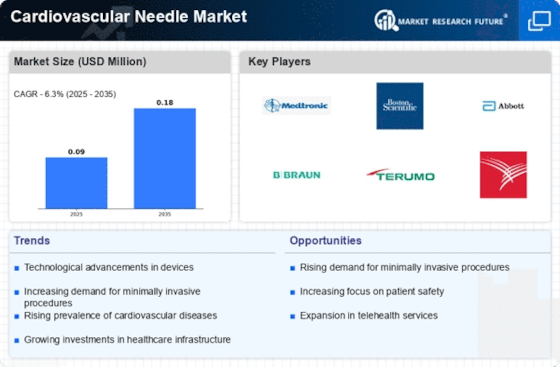

Technological advancements in needle design are significantly influencing the Cardiovascular Needle Market. Innovations such as the development of ultra-thin, flexible needles enhance patient comfort and reduce procedural complications. Furthermore, the integration of smart technologies, including sensors and imaging capabilities, allows for more precise interventions. Market data indicates that the demand for these advanced needles is on the rise, as healthcare professionals increasingly prefer tools that improve accuracy and minimize patient trauma. This trend suggests that the Cardiovascular Needle Market will continue to evolve, driven by the pursuit of enhanced medical technologies.

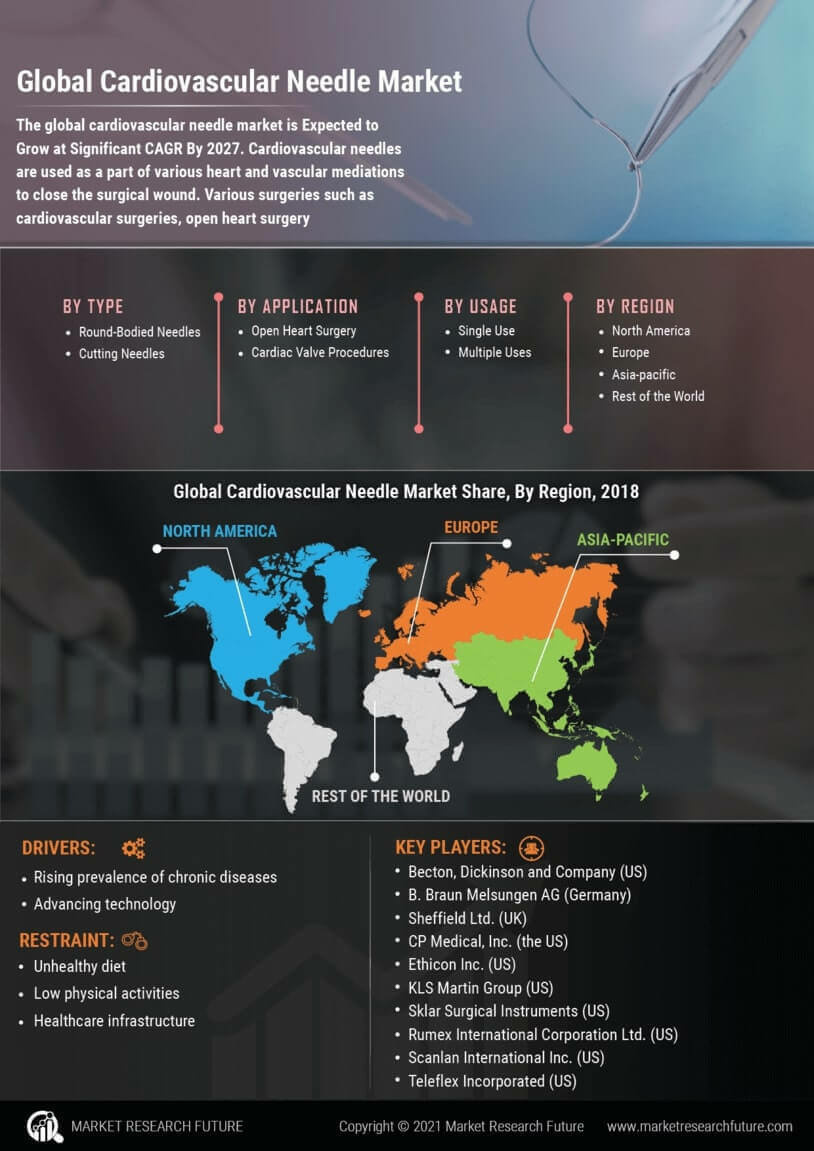

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases is a primary driver for the Cardiovascular Needle Market. As lifestyle-related factors such as obesity, sedentary behavior, and unhealthy diets continue to rise, the demand for effective treatment options escalates. According to recent data, cardiovascular diseases account for a substantial percentage of global mortality, necessitating advanced medical interventions. This trend is likely to propel the need for cardiovascular needles, as healthcare providers seek efficient tools for diagnosis and treatment. The Cardiovascular Needle Market is thus positioned to experience growth, driven by the urgent need for innovative solutions to combat these health challenges.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive procedures is reshaping the Cardiovascular Needle Market. Patients and healthcare providers alike favor techniques that reduce recovery time and minimize surgical risks. As a result, the demand for specialized needles designed for these procedures is increasing. Market analysis reveals that minimally invasive cardiovascular interventions are projected to grow, leading to a corresponding rise in the need for appropriate needle technologies. This trend indicates that the Cardiovascular Needle Market is likely to expand, as manufacturers innovate to meet the evolving preferences of both patients and clinicians.

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a crucial driver for the Cardiovascular Needle Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in emerging markets. This investment often includes the procurement of advanced medical equipment, including cardiovascular needles. Data suggests that as healthcare systems improve, the demand for high-quality medical supplies will rise correspondingly. Consequently, the Cardiovascular Needle Market stands to benefit from this trend, as enhanced infrastructure facilitates better access to cardiovascular care and the tools necessary for effective treatment.