Rising Prevalence of Diabetes

The Needle Free Diabetes Care Market is significantly influenced by the rising prevalence of diabetes worldwide. As the number of individuals diagnosed with diabetes continues to increase, the demand for effective and less invasive treatment options is also on the rise. Current statistics indicate that approximately 463 million adults are living with diabetes, a figure that is expected to reach 700 million by 2045. This alarming trend underscores the urgent need for innovative solutions, such as needle-free delivery systems, which can facilitate better management of the condition. The growing awareness of diabetes complications further propels the market, as patients seek alternatives that minimize discomfort while ensuring effective treatment.

Patient-Centric Healthcare Trends

The Needle Free Diabetes Care Market is benefiting from a shift towards patient-centric healthcare models. This trend emphasizes the importance of patient comfort and satisfaction in treatment protocols. As healthcare providers increasingly prioritize the patient experience, needle-free options are becoming more attractive. The convenience of these systems, which often allow for self-administration, aligns with the growing demand for personalized healthcare solutions. Furthermore, studies suggest that patient compliance improves when treatment methods are less invasive. This shift not only enhances the quality of care but also drives market growth, as more patients opt for needle-free alternatives that align with their lifestyle and preferences.

Government Initiatives and Funding

The Needle Free Diabetes Care Market is also being propelled by various government initiatives aimed at improving diabetes care. Many governments are investing in research and development to promote innovative healthcare solutions, including needle-free delivery systems. Funding programs and grants are increasingly available to support the development of technologies that enhance patient care. For instance, initiatives aimed at reducing healthcare costs and improving patient outcomes are likely to encourage the adoption of needle-free options. This supportive regulatory environment not only fosters innovation but also creates a favorable market landscape for companies specializing in needle-free diabetes care solutions.

Integration of Wearable Technology

The Needle Free Diabetes Care Market is poised for growth due to the integration of wearable technology in diabetes management. Wearable devices that monitor glucose levels continuously are becoming increasingly popular, allowing for real-time data collection and analysis. This integration facilitates the development of needle-free delivery systems that can be synchronized with these devices, providing a seamless experience for users. The market for wearable technology in diabetes care is expected to reach USD 27 billion by 2026, indicating a robust demand for innovative solutions. As patients seek more efficient ways to manage their condition, the combination of wearables and needle-free systems presents a compelling opportunity for market expansion.

Technological Innovations in Needle-Free Devices

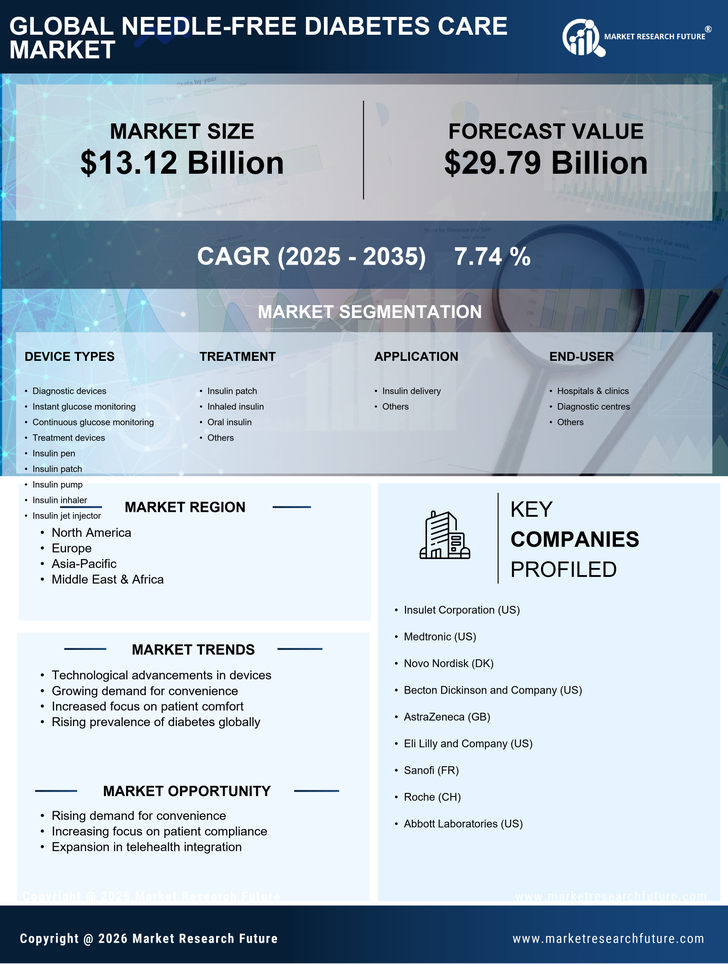

The Needle Free Diabetes Care Market is experiencing a surge in technological innovations that enhance the efficacy and user-friendliness of diabetes management devices. Recent advancements in microneedle technology and jet injectors have made it possible to deliver insulin and other medications without the discomfort associated with traditional needles. These innovations not only improve patient experience but also increase adherence to treatment regimens. According to recent estimates, the market for needle-free delivery systems is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of a broader trend towards minimizing pain and anxiety associated with diabetes care, thereby making needle-free options more appealing to patients.