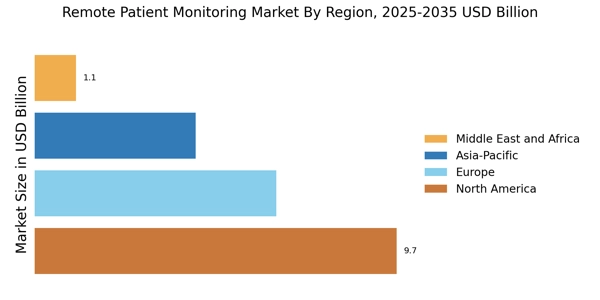

North America : Healthcare Innovation Leader

North America dominated the global Remote Patient Monitoring Market in 2024, reaching a market size of USD 9.7 billion. The region's growth is driven by increasing chronic diseases, technological advancements, and supportive government regulations. The demand for RPM solutions is further fueled by the rising need for cost-effective healthcare delivery and improved patient outcomes. Regulatory catalysts, such as the expansion of Medicare reimbursement for RPM services, are also significant drivers of market growth.

The United States is the leading country in this region, with major players like Medtronic, GE Healthcare, and Abbott dominating the market. The competitive landscape is characterized by continuous innovation and strategic partnerships among key players. Canada also contributes to the market, focusing on enhancing healthcare accessibility through RPM technologies. The presence of advanced healthcare infrastructure and a tech-savvy population further supports the growth of RPM in North America.

Europe : Emerging Market Potential

Europe is witnessing significant growth in the Remote Patient Monitoring Market, accounting for approximately 30% of the global share. The region's expansion is driven by an aging population, increasing prevalence of chronic diseases, and a shift towards value-based healthcare. Regulatory frameworks, such as the European Union's Digital Health Strategy, are fostering innovation and adoption of RPM technologies across member states. Countries like Germany and France are leading the charge, supported by favorable reimbursement policies and investment in digital health initiatives.

Germany stands out as a key player in the European RPM landscape, with a robust healthcare system and a strong presence of companies like Philips and Biotronik. France and the UK are also significant contributors, focusing on integrating RPM into their healthcare systems. The competitive landscape is marked by collaborations between technology firms and healthcare providers, enhancing the delivery of telehealth solutions across Europe.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a rapidly growing market for Remote Patient Monitoring Market, holding around 20% of the global market share. The region's growth is propelled by increasing healthcare expenditure, rising awareness of chronic diseases, and a growing demand for telehealth solutions. Countries like China and India are witnessing a surge in RPM adoption, driven by government initiatives aimed at enhancing healthcare accessibility and affordability. The regulatory environment is becoming more supportive, encouraging investments in health technology.

China is the largest market in the region, with significant contributions from local companies like Omron Healthcare. India is also gaining traction, with a focus on integrating RPM into its healthcare system. The competitive landscape is characterized by a mix of local and international players, fostering innovation and collaboration. The increasing penetration of smartphones and internet connectivity further supports the growth of RPM solutions in Asia-Pacific.

Middle East and Africa : Emerging Healthcare Solutions

The Middle East and Africa region is gradually emerging in the Remote Patient Monitoring Market, accounting for approximately 5% of the global share. The growth is driven by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing focus on digital health solutions. Countries like South Africa and the UAE are leading the way, with government initiatives aimed at improving healthcare infrastructure and accessibility. The regulatory landscape is evolving, promoting the adoption of RPM technologies in the region.

South Africa is a key player in the RPM market, with a growing number of startups and healthcare providers adopting telehealth solutions. The UAE is also making strides, focusing on integrating RPM into its healthcare system. The competitive landscape is characterized by collaborations between local and international companies, enhancing the delivery of remote monitoring solutions. The increasing smartphone penetration and internet access are further driving the growth of RPM in the Middle East and Africa.

.webp