Top Industry Leaders in the Captive Power Generation Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

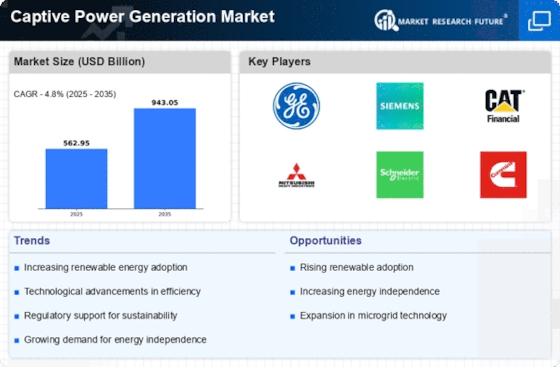

Powering Independence: Exploring the Competitive Landscape of the Captive Power Generation Market

Beneath the hum of the grid, an independent heartbeat emerges - the captive power generation market. This multi-billion dollar space pulsates with activity, with established players, nimble innovators, and regional specialists vying for a share in producing electricity at the source. Let's dissect the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Global Titans: Companies like Siemens, GE Power, and Mitsubishi Heavy Industries leverage their extensive experience, diverse technology portfolios, and global reach to maintain their dominance. They cater to large industrial and commercial customers, offering a wide range of power generation solutions like gas turbines, diesel generators, and renewable energy technologies. Siemens' SGT-X000L gas turbine exemplifies their focus on high-efficiency and environmentally friendly solutions.

Technology Disruptors: Startups like Bloom Energy and Aggreko are disrupting the market with next-generation technologies like solid oxide fuel cells, microgrids, and energy storage solutions. They cater to tech-savvy customers seeking cleaner energy sources, distributed generation, and grid resilience. Bloom Energy's Bloom Box fuel cell showcases their focus on clean and reliable distributed power generation.

Cost-Effective Challengers: Chinese manufacturers like Shanghai Diesel Engine Co. Ltd. and Weichai Power Co. Ltd. are making waves with competitively priced generators and engines, targeting budget-conscious buyers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Shanghai Diesel Engine's diesel generators demonstrate their focus on cost-effective power generation solutions.

Regional Champions: Companies like Wartsila in Finland and Cummins Power Generation in India excel in specific geographic regions, leveraging strong local relationships and deep understanding of regional regulations and fuel resources. They offer tailored solutions like gas-fired generators for regions with abundant natural gas reserves. Cummins Power Generation's gas-fired generators in India exemplify their focus on regional customization.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation technologies like renewables integration, energy storage, and advanced emissions control systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Cost and Financial Viability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive sectors. Companies offering affordable solutions without compromising on efficiency or reliability stand out.

Fuel Availability and Security: Ensuring reliable access to affordable fuel sources like natural gas, diesel, or biomass is paramount for project viability. Companies with strong fuel sourcing capabilities and expertise in alternative fuels gain an edge.

Regulatory Landscape and Compliance: Navigating the evolving regulatory landscape, including emissions regulations, grid interconnection requirements, and government incentives for renewable energy, is crucial for project success. Companies with strong regulatory expertise gain market share.

New and Emerging Trends:

Focus on Renewable Energy Integration: Integrating renewable energy sources like solar and wind into captive power plants creates hybrid systems, reduces reliance on fossil fuels, and enhances sustainability. Companies offering seamless integration solutions stand out.

Microgrid Adoption and Grid Resilience: Developing and deploying microgrids for enhanced energy security, improved grid resilience, and localized energy management creates exciting growth opportunities. Companies with microgrid expertise gain an edge.

Energy Storage and Management: Integrating energy storage solutions like batteries or flywheels with captive power plants optimizes energy usage, reduces peak demand, and improves grid stability. Companies offering comprehensive energy management solutions stand out.

Digitalization and Smart Grid Integration: Implementing digital technologies like IoT sensors, AI-powered data analytics, and smart grid integration for remote monitoring, control, and optimization of captive power generation offers significant efficiency gains. Companies embracing digitalization cater to the demand for intelligent power management.

Overall Competitive Scenario:

The captive power generation market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and regional champions excel in specific markets. Factors like technology innovation, cost, fuel availability, and regulatory compliance play a crucial role in market share analysis. New trends like renewable energy integration, microgrid adoption, energy storage, and digitalization offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace clean energy solutions, and explore technology-driven approaches. By powering independence with efficiency, sustainability, and intelligent management, they can secure a dominant position in this ever-changing landscape.

Doosan Corporation:

• Recently secured an order for a 178 MW biomass-based power plant in India. (Source: Doosan Corporation website, July 2023)

ArcelorMittal:

• Commissioned a 44 MW solar power plant at its Hazira steel plant in India. (Source: ArcelorMittal website, May 2023)

Hindustan Zinc:

• Partnering with Greenko Energies to develop a 300 MW solar power plant for its Chanderiya smelter. (Source: Greenko Energies website, September 2023)

General Electric (GE):

• Launched its Jenbacher gas engines specifically designed for captive power applications. (Source: GE Power website, April 2023)

Reliance Industries:

• Investing heavily in solar and wind power capacity for its own captive needs. (Source: Bloomberg, December 2023)

Top listed global companies in the industry are:

Doosan Corporation

ArcelorMittal

Hindustan Zinc.

General Electric

Reliance Industries

Jindal Steel & Power

Hindalco Industries

Essar Steel

Bharat Heavy Electricals

Clarke Energy

a Kohler Company

Thermax Limited

NALCO India

Siemens

Wartsila

LafargeHolcim