Innovation in Food Technology

Advancements in food technology are playing a crucial role in the chickpea protein-ingredients market. Innovations in processing techniques are enhancing the functionality and sensory attributes of chickpea protein, making it more appealing to food manufacturers. For instance, improved extraction methods are increasing the yield and quality of chickpea protein, which can be utilized in a variety of applications, from baked goods to dairy alternatives. This technological progress suggests that the chickpea protein-ingredients market may continue to evolve, offering new opportunities for product development and consumer engagement.

Support from Government Initiatives

Government initiatives aimed at promoting plant-based diets and sustainable agriculture are likely to bolster the chickpea protein-ingredients market in Brazil. Policies encouraging the cultivation of legumes, including chickpeas, are being implemented to enhance food security and reduce environmental impact. These initiatives may lead to increased production and availability of chickpea protein-ingredients, making them more accessible to manufacturers and consumers alike. As the government continues to support sustainable practices, the market for chickpea protein-ingredients could experience significant growth.

Health Consciousness Among Consumers

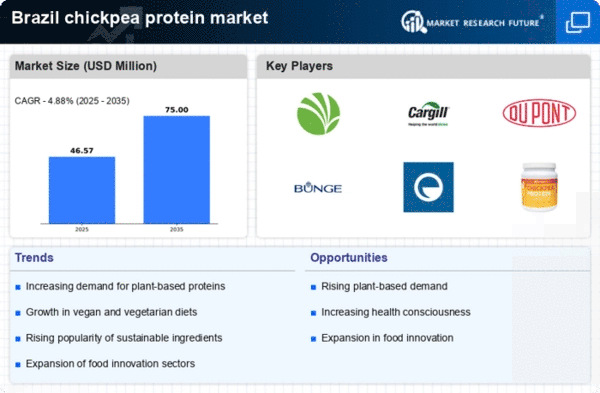

The increasing awareness of health and nutrition among Brazilian consumers appears to be a significant driver for the chickpea protein-ingredients market. As individuals become more health-conscious, they are actively seeking alternatives to animal-based proteins. Chickpea protein, known for its high protein content and essential amino acids, is gaining traction. Recent data indicates that the demand for plant-based proteins in Brazil has surged by approximately 25% over the past few years. This shift in consumer preferences is likely to propel the chickpea protein-ingredients market, as more people incorporate these ingredients into their diets for health benefits.

Rising Popularity of Functional Foods

The trend towards functional foods in Brazil is influencing the chickpea protein-ingredients market. Consumers are increasingly interested in foods that offer health benefits beyond basic nutrition. Chickpea protein is often marketed for its potential to support muscle growth, weight management, and overall health. The functional food sector in Brazil has seen a growth rate of around 20% annually, indicating a robust market for ingredients that provide added value. This trend suggests that chickpea protein-ingredients will likely find a prominent place in the formulations of health-oriented products.

Growth of the Vegan and Vegetarian Population

The rise in the number of vegans and vegetarians in Brazil is contributing to the expansion of the chickpea protein-ingredients market. With an estimated 14% of the population identifying as vegetarian or vegan, there is a growing need for plant-based protein sources. Chickpeas, being versatile and nutritious, are increasingly utilized in various food products, from snacks to meat alternatives. This demographic shift suggests a sustained demand for chickpea protein-ingredients, as consumers seek to replace traditional protein sources with plant-based options that align with their dietary choices.