Growing Entertainment Sector

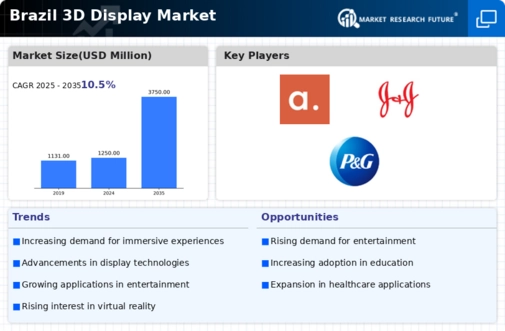

The Brazil 3D display market is experiencing a notable surge due to the expanding entertainment sector. With a population that increasingly seeks immersive experiences, the demand for 3D displays in cinemas, gaming, and live events is on the rise. In 2025, the Brazilian film industry reported a revenue increase of approximately 15%, indicating a robust appetite for innovative viewing experiences. This growth is likely to drive investments in advanced 3D display technologies, as entertainment providers aim to enhance audience engagement. Furthermore, the proliferation of streaming services in Brazil, which often feature 3D content, suggests a sustained demand for high-quality 3D displays. As a result, the entertainment sector's expansion is a critical driver for the Brazil 3D display market, fostering innovation and competition among manufacturers.

Increasing Adoption in Education

The Brazil 3D display market is witnessing increased adoption in the education sector, driven by the need for innovative teaching methods. Educational institutions are increasingly utilizing 3D displays to create interactive learning environments, which enhance student engagement and comprehension. In 2025, it is estimated that 30% of Brazilian schools will incorporate 3D display technologies into their curricula. This trend is supported by government initiatives aimed at modernizing education and promoting digital literacy. Furthermore, the use of 3D displays in training programs for professionals, particularly in fields such as medicine and engineering, is likely to expand. As educational institutions recognize the benefits of immersive learning experiences, the Brazil 3D display market is expected to grow significantly, fostering a new generation of learners equipped with advanced skills.

Supportive Regulatory Environment

The Brazil 3D display market is bolstered by a supportive regulatory environment that encourages technological innovation and investment. The Brazilian government has implemented various policies aimed at fostering the growth of the technology sector, including tax incentives for companies investing in research and development. In 2025, the government is expected to allocate additional funding to support tech startups focused on display technologies, which could lead to breakthroughs in the 3D display market. Furthermore, initiatives promoting digital transformation across industries are likely to create new opportunities for 3D display applications. As the regulatory landscape continues to evolve, the Brazil 3D display market is positioned to thrive, attracting both domestic and international players seeking to capitalize on emerging trends.

Advancements in Display Technology

Technological advancements play a pivotal role in shaping the Brazil 3D display market. Innovations such as OLED and MicroLED technologies are enhancing the quality and efficiency of 3D displays, making them more appealing to consumers. In 2025, the market for OLED displays in Brazil is projected to grow by 20%, reflecting a shift towards superior display technologies. These advancements not only improve visual quality but also reduce energy consumption, aligning with Brazil's sustainability goals. Additionally, the integration of artificial intelligence in display technologies is expected to further enhance user experience by providing personalized content. As manufacturers continue to invest in research and development, the Brazil 3D display market is likely to benefit from these technological breakthroughs, leading to a more competitive landscape.

Rising Demand in Retail and Advertising

The Brazil 3D display market is significantly influenced by the rising demand for innovative retail and advertising solutions. Retailers are increasingly adopting 3D displays to create captivating in-store experiences that attract customers and enhance product visibility. In 2025, it is projected that 25% of retail stores in Brazil will implement 3D display technologies as part of their marketing strategies. This shift is driven by the need to differentiate brands in a competitive market and engage consumers more effectively. Additionally, advertising agencies are leveraging 3D displays for dynamic and interactive campaigns, which are shown to increase consumer engagement by up to 40%. As the retail landscape evolves, the Brazil 3D display market is likely to benefit from these trends, leading to increased investments and innovation in display technologies.