Regulatory Environment

The regulatory landscape surrounding digital advertising is a critical driver for the programmatic display-advertising market in Brazil. With increasing scrutiny on data privacy and consumer protection, regulations are evolving to ensure transparency and accountability in advertising practices. In 2025, it is anticipated that new regulations will be implemented, impacting how data is collected and utilized in programmatic advertising. Advertisers must navigate these changes carefully, adapting their strategies to comply with legal requirements while still achieving effective targeting. This regulatory environment may pose challenges, but it also presents opportunities for companies that prioritize ethical advertising practices. As the market adapts to these regulations, it is likely to foster greater trust among consumers, ultimately benefiting the programmatic display-advertising market.

Rising Digital Ad Spend

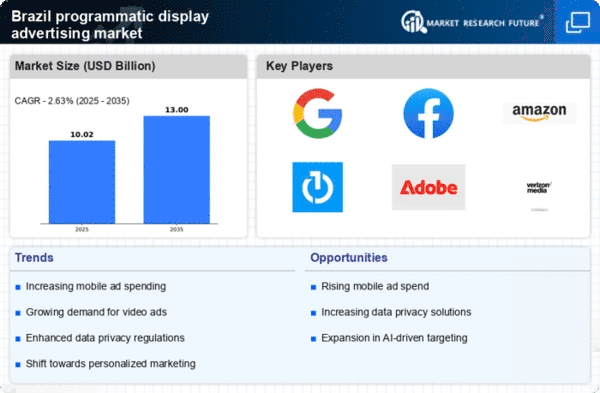

The programmatic display-advertising market in Brazil is experiencing a notable increase in digital ad expenditure. In recent years, businesses have shifted their marketing budgets towards digital platforms, with a reported growth of approximately 20% in 2025. This trend is driven by the increasing recognition of the effectiveness of digital advertising in reaching targeted audiences. As more companies allocate funds to programmatic advertising, the competition intensifies, leading to enhanced innovation and efficiency in ad placements. The Brazilian market is particularly responsive to digital trends, with a growing number of consumers engaging with online content. This shift in spending patterns indicates a robust future for the programmatic display-advertising market, as advertisers seek to optimize their return on investment through data-driven strategies.

Consumer Behavior Shifts

The programmatic display-advertising market in Brazil is significantly influenced by changing consumer behaviors. As more individuals engage with digital content, their preferences and habits evolve, prompting advertisers to adapt their strategies. In 2025, it is projected that approximately 75% of Brazilian consumers will prefer personalized advertising experiences. This shift necessitates a more targeted approach in programmatic advertising, where understanding consumer preferences becomes paramount. Advertisers are increasingly leveraging data analytics to tailor their messages, ensuring relevance and resonance with their audience. This evolution in consumer behavior not only enhances engagement rates but also drives the demand for more sophisticated programmatic solutions, indicating a dynamic landscape for the market.

Advancements in Technology

Technological advancements play a crucial role in shaping the programmatic display-advertising market in Brazil. The integration of sophisticated algorithms and machine learning techniques has revolutionized how ads are targeted and delivered. In 2025, it is estimated that over 60% of programmatic ad transactions will utilize artificial intelligence to enhance targeting precision. This technological evolution allows advertisers to analyze vast amounts of data in real-time, optimizing campaigns for better performance. Furthermore, the rise of connected devices and the Internet of Things (IoT) expands the avenues for programmatic advertising, enabling brands to reach consumers across multiple platforms seamlessly. As technology continues to evolve, the programmatic display-advertising market is likely to witness further growth and innovation.

Emergence of New Platforms

The emergence of new digital platforms is reshaping the programmatic display-advertising market in Brazil. As social media and streaming services continue to grow in popularity, advertisers are increasingly exploring these channels for programmatic ad placements. In 2025, it is expected that spending on programmatic ads across emerging platforms will rise by 30%, reflecting the changing landscape of consumer engagement. These platforms offer unique opportunities for targeted advertising, allowing brands to connect with audiences in innovative ways. The diversification of advertising channels not only enhances the reach of campaigns but also encourages creativity in ad formats. As new platforms gain traction, the programmatic display-advertising market is likely to expand, providing advertisers with a broader array of options to engage consumers.