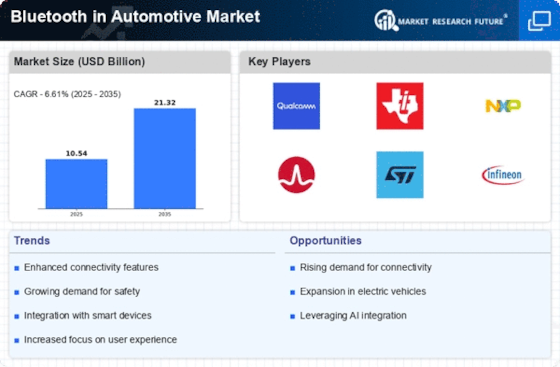

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Bluetooth in Automotive Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Bluetooth in Automotive industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Bluetooth in Automotive Market industry to benefit clients and increase the market sector. In recent years, the Bluetooth in Automotive industry has offered some of the most significant advantages to medicine. Major players in the Bluetooth in Automotive Market, including Texas Instruments Incorporated, QUALCOMM Incorporated, Cypress Semiconductor Corporation, Marvell Technology Group Ltd, Toshiba Corporation, Samsung Corporation, Semiconductor Corporation, Broadcom Corporation, Pioneer Corporation, and Silicon Laboratories, are attempting to increase market demand by investing in research and development operations.

Panasonic Holdings Corp. (Panasonic), formerly known as Panasonic Corp., is a global manufacturer, retailer, and service provider of a wide range of electric and electronic products. Individual room air conditioners, TVs, landlines, digital cameras, home audio and video equipment, rice cookers, lamps, wiring devices, air conditioners, air purifiers, and bicycles are just a few of the things Panasonic offers. In addition, it sells PCs, tablets, batteries, electric motors, mounting machines, semiconductors, LCD panels, electronic materials, electronic components, and electronic materials. The company manages and operates facilities and R&D locations in Europe, Asia, the Americas, and Japan.

Panasonic's corporate headquarters are in Kadoma-shi in the Japanese city of Osaka.

In May Panasonic Corporation revealed the new frictionless connectivity solution, which is a safer way to wirelessly link mobile devices with automobiles.

Qualcomm Inc. creates and creates digital wireless telecommunications products and services. System software and integrated circuits for wireless mobile devices are sold by the company. Among its product lines are radio frequency transceivers, modems, processors, consumer wireless goods, integrated chipsets for wireless communication, and power management. The company's products are used in a variety of products, including mobile phones, laptops, handheld wireless computers, data modules, routers, access points, gateway equipment, desktop computers, gaming devices, infrastructure equipment, and Internet of Things (IoT) devices.

The corporation has operations in a number of nations, including Brazil, China, France, Germany, India, Mexico, South Korea, Indonesia, Japan, the UK, and the United States. Qualcomm's global headquarters are in San Diego, California.

In May Qualcomm revealed a new infotainment control platform.