Leading market players are investing heavily in research and development to expand their product lines, which will help the bluetooth IC market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the bluetooth IC industry must offer cost-effective items.

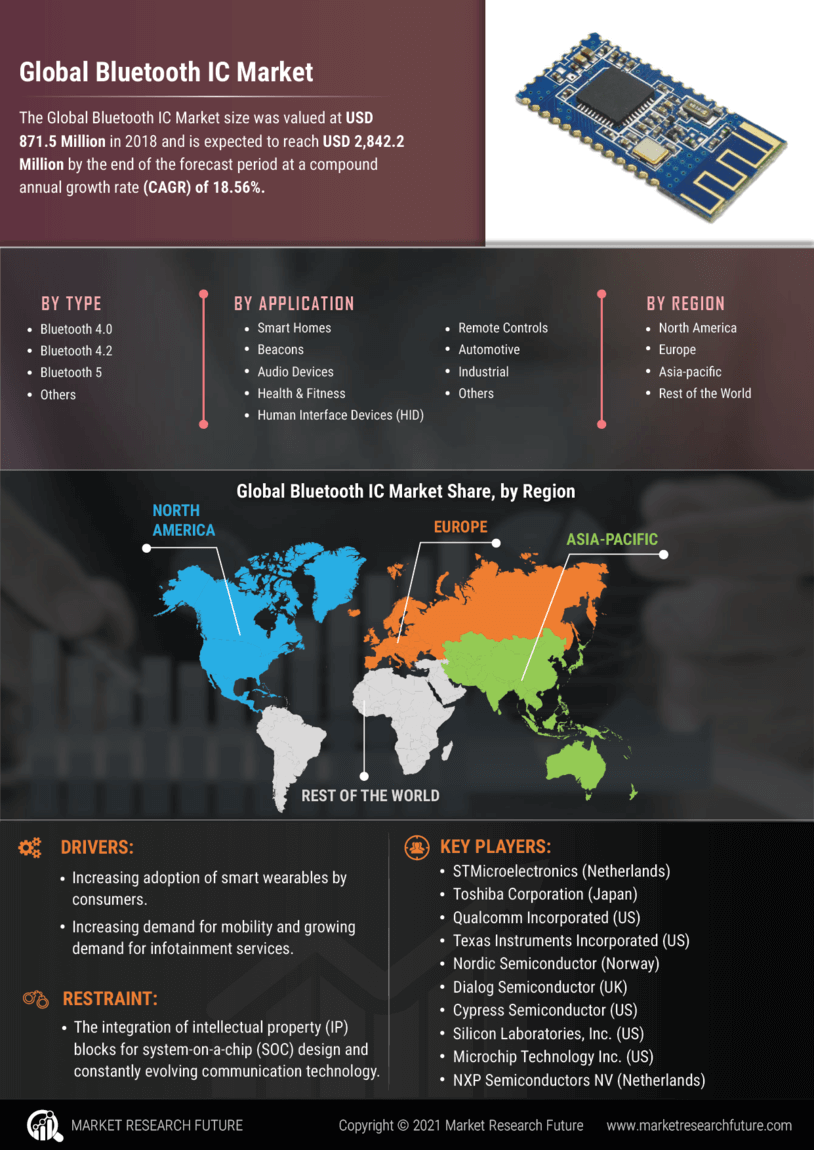

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the bluetooth IC industry to benefit clients and increase the market sector. Major players in the Bluetooth IC Market, including STMicroelectronics (Netherlands), Toshiba Corporation (Japan), Qualcomm Incorporated (US), Texas Instruments Incorporated (US), and Nordic Semiconductor (Norway) and others, are attempting to expand market demand by investing in research and development operations.

Nordic Semiconductor ASA is a provider of semiconductor devices. The company offers designing, marketing, and delivering integrated circuits (ICs), mobile apps, integrated solutions, and related intellectual property. The company's products include low-energy components, bluetooth mesh, ANT, 2.4 GHz proprietary and others. Its products find application in manufacturing personal computer (PC) accessories, gaming controllers, sports and health monitors, education, industrial products, and other applications.

In February Nordic Semiconductor introduced the nRF52811 System-on-Chip (SoC). This fully featured connectivity solution supports Bluetooth 5.1 direction finding and various popular low-power wireless protocols for applications such as gateways for smart homes and industrial products.

The SoC enhanced Nordic's well-known nRF52 Series platform by launching a device that manages to combine the low cost of Nordic's entry-level nRF52810 SoC with the multiprotocol support of Nordic's mid-range nRF52832 and advances nRF52840 SoCs.

Qualcomm Inc designs and develops wireless telecommunication products and services. The firm offers integrated circuits and system software for mobile devices and other wireless products. Its product offerings such as consumer wireless devices, cellular modems, radio frequency transceivers, application processors, power management and wireless connectivity integrated circuits. The company's products find applications in mobile devices, laptops, tablets, cellular handsets, cameras, servers, wireless devices and network infrastructure equipment, routers, access points, wearable devices, voice and music devices, gateway equipment, consumer electronic devices, desktop computers, and IoT devices.

In April 2022, Qualcomm acquired Arriver from SSW Partners to boost Qualcomm Technologies' ability to provide open, fully incorporated, and Advanced Driver Assistance System (ADAS) solutions to automakers and Tier-1 suppliers at scale.