Market Analysis

In-depth Analysis of Bluetooth in Automotive Market Industry Landscape

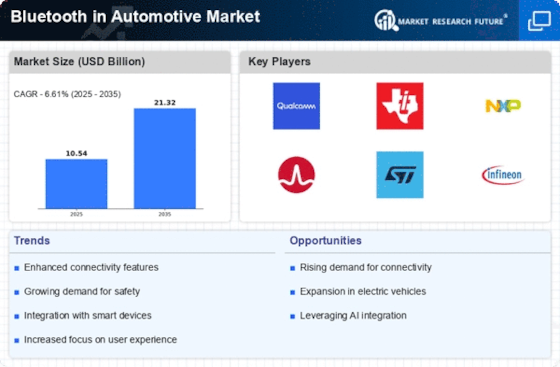

The Bluetooth in the automotive market is experiencing robust growth and undergoing comprehensive analysis to understand its intricate dynamics and potential for evolution. This market analysis delves into various key aspects that define the current landscape and shape the trajectory of Bluetooth technology within the automotive sector.

One pivotal factor contributing to the market's growth is the increasing consumer demand for enhanced in-car connectivity. Bluetooth, with its versatility and capability for seamless wireless communication, has become a linchpin in meeting this demand. The market analysis focuses on the rising trend of Bluetooth integration into advanced driver-assistance systems (ADAS) and infotainment systems. This integration is not only enhancing the overall driving experience but also addressing safety concerns by providing hands-free calling, music streaming, and navigation features.

The analysis also emphasizes the growing significance of Bluetooth Low Energy (BLE) technology in the automotive sector. As the industry shifts towards electric and hybrid vehicles, there is a heightened emphasis on energy-efficient connectivity solutions. BLE, with its low power consumption, is gaining prominence in applications like keyless entry systems and tire pressure monitoring, aligning with the industry's commitment to sustainability.

Additionally, the market analysis explores the integration of Bluetooth into vehicle-to-everything (V2X) communication systems. This technology is becoming instrumental in fostering communication between vehicles and infrastructure, contributing to advancements in cooperative driving and the development of connected and autonomous vehicles. The analysis delves into the role Bluetooth plays in supporting V2X communication and its implications for the automotive industry.

Moreover, the analysis takes into account the rise of connected car platforms and the pivotal role Bluetooth plays in enabling seamless communication between vehicles and external platforms. This includes over-the-air updates, vehicle diagnostics, and other connected services that enhance user experience and allow automakers to offer advanced features remotely.

The Bluetooth in the automotive market analysis sheds light on the multifaceted trends and technologies shaping the industry. It recognizes Bluetooth as a fundamental enabler of connectivity, safety, and innovation within the automotive sector, paving the way for an exciting future of smart and connected vehicles.

Leave a Comment