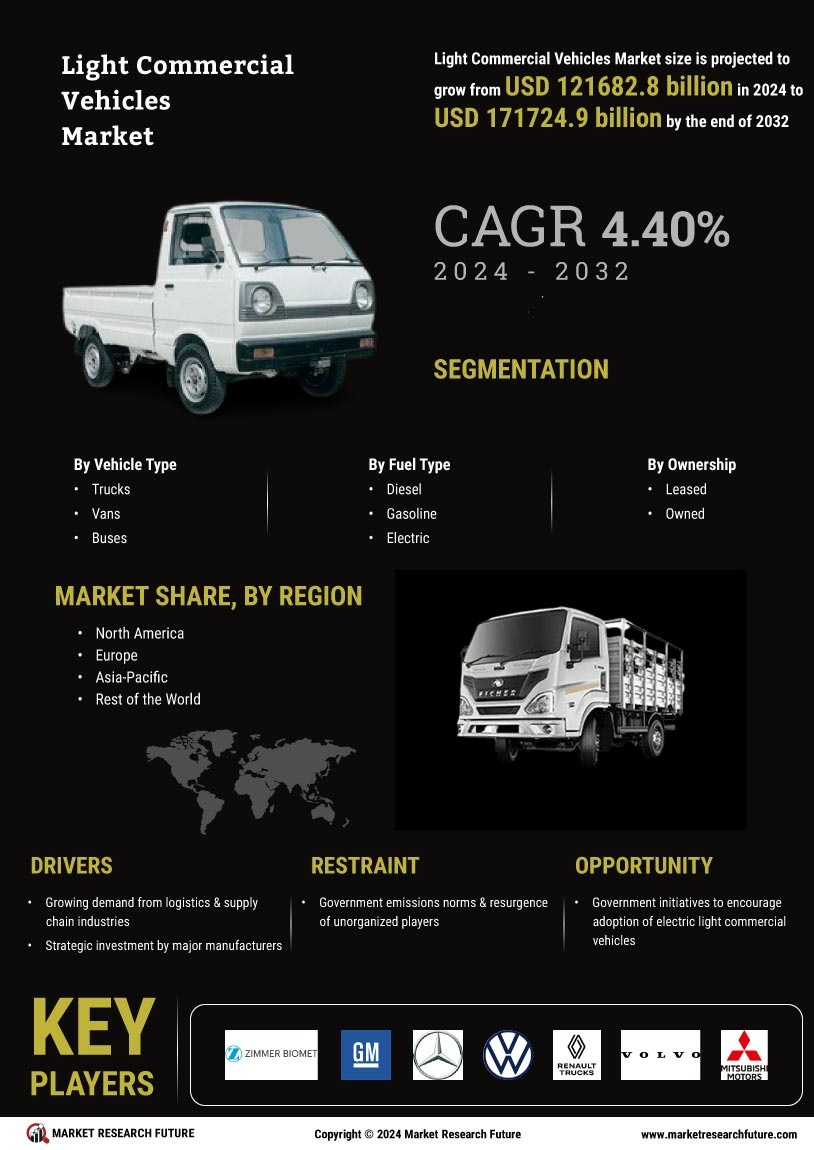

Market Growth Projections

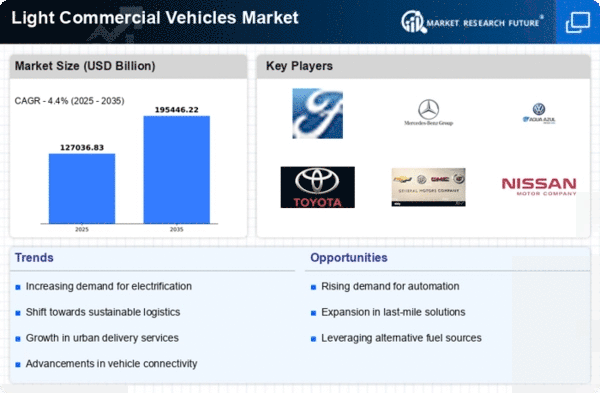

The Global Light Commercial Vehicle (LCV) Market is poised for substantial growth, with projections indicating a market size of 531.7 USD Billion in 2024 and an anticipated increase to 795.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 3.72% from 2025 to 2035. Such projections are indicative of the increasing reliance on LCVs across various sectors, including retail, construction, and logistics. The expansion of e-commerce, urbanization, and technological advancements are likely to contribute to this growth, highlighting the LCV market's potential in meeting evolving transportation needs.

Increasing Demand for E-commerce

The surge in e-commerce activities globally drives the Light Commercial Vehicle (LCV) Market significantly. As online shopping continues to gain traction, businesses require efficient delivery solutions, which often involve LCVs. In 2024, the market is projected to reach 531.7 USD Billion, reflecting the growing reliance on LCVs for last-mile delivery. Companies are increasingly investing in their logistics capabilities to meet consumer expectations for rapid delivery, thereby enhancing the demand for LCVs. This trend is likely to persist, as e-commerce sales are anticipated to grow, further solidifying the role of LCVs in supply chain operations.

Growing Demand for Fleet Services

The increasing demand for fleet services is a notable driver of the Light Commercial Vehicle (LCV) Market. Businesses are increasingly outsourcing their logistics and transportation needs to specialized fleet service providers, which often utilize LCVs for their operations. This trend is expected to grow, with the market projected to reach 795.0 USD Billion by 2035, indicating a robust CAGR of 3.72% from 2025 to 2035. As companies seek to optimize their supply chains and reduce operational costs, the reliance on fleet services is likely to enhance the demand for LCVs, further solidifying their role in the logistics ecosystem.

Regulatory Support for Emission Standards

The Light Commercial Vehicle (LCV) Market is influenced by regulatory frameworks aimed at reducing emissions and promoting sustainability. Governments worldwide are implementing stricter emission standards, encouraging manufacturers to develop cleaner vehicles. This regulatory support is likely to drive innovation in the LCV sector, as companies invest in research and development to comply with these standards. The transition towards low-emission vehicles is expected to create new market opportunities, particularly as consumers become more environmentally conscious. As a result, the LCV market may witness a shift towards electric and hybrid models, aligning with global sustainability goals.

Urbanization and Infrastructure Development

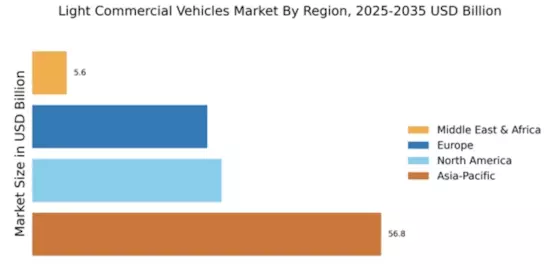

Rapid urbanization and ongoing infrastructure development across the globe contribute to the expansion of the Light Commercial Vehicle (LCV) Market. As cities grow, the need for transportation solutions that can navigate urban environments becomes paramount. LCVs are particularly suited for urban logistics due to their size and maneuverability. Governments are investing in infrastructure projects, which often include the enhancement of road networks, thereby facilitating smoother operations for LCVs. This trend is expected to continue, with urban areas increasingly relying on LCVs to support local businesses and services, ultimately driving market growth.

Technological Advancements in Vehicle Design

Technological innovations in vehicle design and manufacturing are reshaping the Light Commercial Vehicle (LCV) Market. Advances in materials, engine efficiency, and safety features are making LCVs more appealing to businesses. For instance, the integration of electric and hybrid technologies is gaining traction, as companies seek to reduce their carbon footprint while maintaining operational efficiency. This shift towards greener alternatives is likely to attract new customers and expand market share. As the industry evolves, the adoption of smart technologies, such as telematics and connectivity features, is expected to enhance fleet management, further driving demand for LCVs.