Focus on Fleet Management Solutions

The emphasis on fleet management solutions is emerging as a key driver in the Commercial Vehicles Lubricant Market. Fleet operators are increasingly adopting advanced management systems to monitor vehicle performance and optimize maintenance schedules. This trend is likely to boost the demand for specialized lubricants that enhance engine efficiency and reduce wear. In 2025, the market for fleet management solutions is expected to grow, driven by the need for cost-effective operations and improved vehicle uptime. As fleet managers seek to implement data-driven strategies, the demand for lubricants that align with these technologies will likely increase. This focus on efficiency and performance is expected to create a favorable environment for lubricant manufacturers to innovate and expand their product offerings.

Regulatory Compliance and Standards

Regulatory compliance plays a crucial role in shaping the Commercial Vehicles Lubricant Market. Governments worldwide are implementing stringent regulations regarding emissions and fuel efficiency, compelling manufacturers to innovate and produce lubricants that meet these standards. For instance, the introduction of low-SAPS (Sulfated Ash, Phosphorus, and Sulfur) lubricants is a response to environmental regulations aimed at reducing harmful emissions from commercial vehicles. The market for these specialized lubricants is expected to witness a notable increase, as compliance with regulations becomes a priority for fleet operators. In 2025, it is anticipated that the demand for eco-friendly lubricants will rise, further driving the market as companies seek to align with sustainability goals while adhering to legal requirements.

Rising Demand for Commercial Vehicles

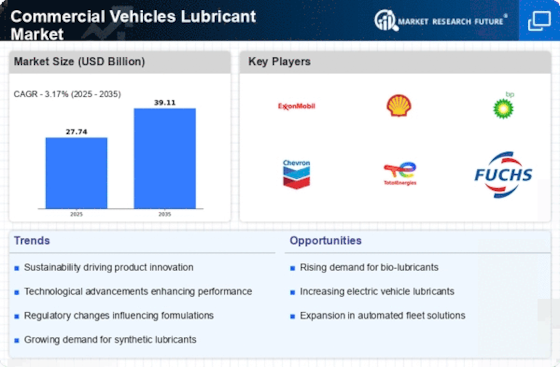

The increasing demand for commercial vehicles is a primary driver for the Commercial Vehicles Lubricant Market. As economies expand, the need for transportation of goods and services rises, leading to a surge in commercial vehicle production. In 2025, the commercial vehicle segment is projected to grow at a compound annual growth rate of approximately 4.5%. This growth is likely to stimulate the demand for high-performance lubricants that enhance engine efficiency and longevity. Furthermore, the expansion of logistics and supply chain networks necessitates reliable lubricants to ensure optimal vehicle performance. Consequently, manufacturers are focusing on developing advanced lubricants tailored to meet the specific requirements of various commercial vehicles, thereby propelling the market forward.

Technological Innovations in Lubricants

Technological advancements in lubricant formulations are significantly influencing the Commercial Vehicles Lubricant Market. Innovations such as synthetic lubricants and advanced additive technologies are enhancing the performance and efficiency of lubricants. These developments not only improve engine protection but also extend oil change intervals, which is particularly beneficial for commercial vehicle operators looking to reduce maintenance costs. In 2025, the market for synthetic lubricants is expected to grow, driven by their superior performance characteristics compared to conventional oils. Additionally, the integration of smart technologies in lubricant management systems is likely to optimize lubricant usage, further propelling market growth. As manufacturers continue to invest in research and development, the introduction of next-generation lubricants will likely reshape the competitive landscape.

Growth of E-commerce and Delivery Services

The rapid growth of e-commerce and delivery services is a significant driver for the Commercial Vehicles Lubricant Market. As online shopping becomes increasingly prevalent, the demand for commercial vehicles used in logistics and last-mile delivery is surging. This trend necessitates the use of high-quality lubricants to ensure the reliability and efficiency of delivery vehicles. In 2025, the logistics sector is projected to expand, leading to an increased requirement for lubricants that can withstand the demands of frequent stop-and-go operations. Consequently, lubricant manufacturers are likely to focus on developing products that cater specifically to the needs of delivery fleets, thereby enhancing their market presence. This shift towards e-commerce-driven logistics is expected to create new opportunities for lubricant suppliers.