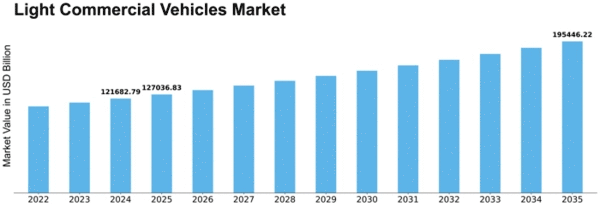

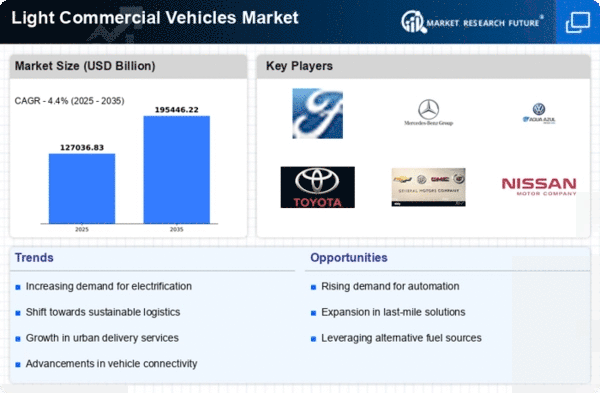

Light Commercial Vehicles Size

Light Commercial Vehicles Market Growth Projections and Opportunities

Numerous factors influence the Light Commercial Vehicles (LCV) industry and collectively shape its components. The financial scene is one important factor. The demand for LCVs is intricately linked to a region's financial stability. Businesses expand in periods of economic expansion, which increases demand for transportation and conveyance services and, in turn, fuels demand for LCVs. However, financial downturns may result in fewer commercial workouts, which would be bad for the LCV industry. The layout and construction of LCVs are influenced by outflow criteria, wellbeing requirements, and eco-friendliness prerequisites enforced by administrative professionals. States all over the world are becoming increasingly reliant on natural maintainability, which is increasing demand for environmentally friendly and environmentally accommodating LCVs. Rigid emission requirements and incentives for hybrid and electric cars contribute to the LCV market's ongoing evolution. Buyer inclinations are influenced by advancements in car plan, motor effectiveness, and network features. Particularly fleet managers are drawn to cars with the newest technology installed since it increases operational efficiency, promotes wellness, and provides constant information. The integration of IoT and telematics systems in LCVs considers enhancing fleet management, updating training, reducing fuel consumption, and generally increasing efficiency. In the LCV industry, buyer preferences and lifestyle changes are important factors. More people are interested in last-mile delivery services due to the growth of online commerce and shifting consumer preferences, which reinforces the need for more affordable, more adaptable LCVs. Additionally, the growth of the gig economy has led to a demand for conservative and flexible vehicles that meet the needs of independent businesses and self-employed individuals. International trade factors also impact the LCV industry, particularly in regions with strong product and import markets. Increased demand for transportation services is typically correlated with increased worldwide trade, which has a significant effect on the LCV industry. Conversely, exchange pressures and disruptions can have adverse effects, causing susceptibilities and hesitations. Fuel prices have a significant impact on the LCV industry. As a result, companies may alter their preferences for vehicles based on environmental factors, gravitating toward more fuel-efficient options when gasoline prices are high.

Leave a Comment