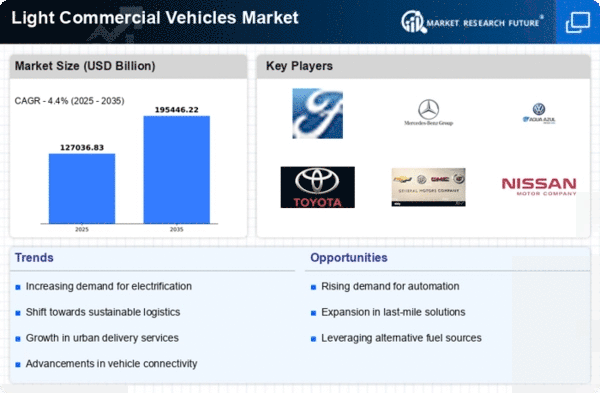

Top Industry Leaders in the Light Commercial Vehicles Market

*Disclaimer: List of key companies in no particular order

The Evolving Turf: Competitive Landscape of Light Commercial Vehicles Market

The dynamic light commercial vehicle (LCV) market, which encompasses vans, pickups, and small trucks, is characterized by vibrant activity. Fueled by the growth in e-commerce and logistics sectors, the competitive landscape within this thriving sector is a complex interplay of established players, nimble startups, and the looming presence of tech giants.

Strategic Players:

- Ford Motor Company

- General Motors

- Daimler AG

- Volkswagen AG

- Renault Trucks

- Volvo Group

- Mitsubishi Motor Corporation

- PACCAR Inc.

- Hyundai Motor Company

- Nissan Motor Company Ltd., and others.

- Traditional Titans: Automotive giants such as Ford, Toyota, and General Motors utilize their extensive networks, brand recognition, and diverse product portfolios to maintain market dominance. Their emphasis is on robust performance, fuel efficiency, and driver comfort, targeting established customer segments.

- Regional Ripples: Companies like SAIC Motor and FAW in China, Tata Motors in India, and Mitsubishi Fuso in Japan have strong regional footholds. They tailor their offerings to local infrastructure, payload requirements, and cost sensitivities, carving out dedicated niches.

- Start-up Sprint: Agile startups like Rivian and Arrival Automotive bring disruption and innovation to the market, particularly in electric LCVs. They leverage cutting-edge battery technology and prioritize customization to appeal to tech-savvy urban delivery fleets.

- Tech Giants Invade: Tech behemoths like Amazon and Google are entering the LCV market with autonomous driving solutions. Their focus on last-mile delivery efficiency and cost optimization could reshape the competitive landscape, posing potential challenges to established players.

Market Share Analysis Factors: • Geographic Footprint: Companies with extensive geographic reach and established dealership networks have a competitive edge, particularly in emerging markets with evolving infrastructure and distribution channels.

- Product Portfolio Diversity: Offering a diverse range of LCVs catering to various payload capacities, body types, and fuel options expands customer appeal and market share.

- Technological Prowess: Embracing electrification, advanced driver-assistance systems (ADAS), and connectivity features attracts tech-savvy customers and future-proofs businesses.

- Customer Relationship Management: Building strong relationships with fleet operators and logistics companies through tailored after-sales services and financing options fosters loyalty and repeat business.

New and Emerging Trends: • Electric LCVs Surge: Growing environmental concerns and government incentives are propelling the electric LCV segment. Companies like Ford with the E-Transit and GM with the BrightDrop Zevo 67 are competing for dominance.

- Connected Vehicles Rise: Integration of telematics and IoT technologies allows for real-time fleet management, optimizing efficiency and reducing operational costs. This trend is fostering partnerships between automotive companies and tech giants.

- Customization Reigns Supreme: Customers demand bespoke LCVs tailored to their specific needs. Start-ups are addressing this demand with modular platforms and flexible configurations, challenging traditional manufacturers.

- Subscription Models Emerge: Pay-per-use models are gaining traction, particularly for urban deliveries, catering to businesses with fluctuating demand and reducing upfront investment costs.

Overall Competitive Scenario: The LCV market is a dynamic arena with established players facing aggressive competition from start-ups and tech giants. Success hinges on adapting to the evolving landscape by embracing electrification, digitalization, and customization. Companies that prioritize customer-centric solutions, agile product development, and strategic partnerships will hold the competitive edge in this rapidly transforming market.

Industry Developments and Latest Updates:

Ford Motor Company: • October 26, 2023: Ford unveils the all-new Transit Connect electric van, offering increased range and cargo capacity. (Source: Ford Media Center)

General Motors: • December 12, 2023: GM announces plans to invest $1 billion in its Silao, Mexico plant to produce electric Silverado pickup trucks and light commercial vehicles. (Source: GM Press Release)

Daimler AG: • December 07, 2023: Mercedes-Benz Trucks unveils the eSprinter electric van with improved range and payload capacity. (Source: Mercedes-Benz Trucks website)

Volkswagen AG: • December 05, 2023: Volkswagen Commercial Vehicles announces plans to launch the ID. Buzz electric cargo van in North America in 2024. (Source: Volkswagen Commercial Vehicles website)