E-commerce Growth

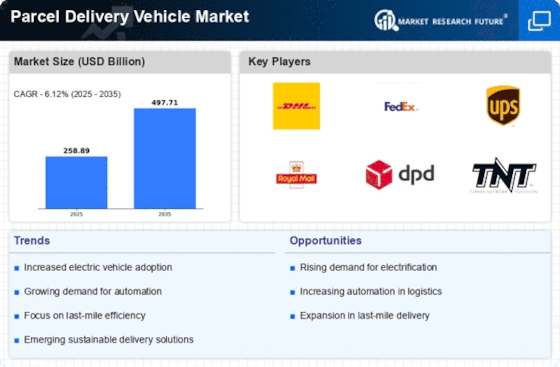

The Parcel Delivery Vehicle Market is experiencing a notable surge due to the rapid expansion of e-commerce. As online shopping becomes increasingly prevalent, the demand for efficient parcel delivery solutions intensifies. In 2025, e-commerce sales are projected to reach approximately 6 trillion USD, necessitating a robust logistics framework. This growth compels companies to invest in specialized delivery vehicles that can navigate urban environments and meet consumer expectations for speed and reliability. The rise of same-day and next-day delivery services further drives the need for innovative parcel delivery vehicles, which are designed to optimize delivery routes and enhance operational efficiency. Consequently, the Parcel Delivery Vehicle Market is poised for significant growth as businesses adapt to the evolving landscape of consumer behavior.

Last-Mile Delivery Innovations

Innovations in last-mile delivery are reshaping the Parcel Delivery Vehicle Market. As urban areas become more congested, traditional delivery methods face challenges in efficiency and timeliness. Companies are increasingly adopting electric vehicles, drones, and autonomous delivery systems to address these issues. For instance, the use of electric vans is projected to grow by 25% annually, driven by sustainability goals and regulatory pressures. These innovations not only reduce carbon emissions but also enhance delivery speed and reliability. The integration of advanced routing software and real-time tracking systems further optimizes last-mile logistics, making it a critical focus area for the Parcel Delivery Vehicle Market. As urban logistics evolve, the demand for vehicles that can adapt to these innovations is likely to increase.

Regulatory Compliance and Sustainability

The Parcel Delivery Vehicle Market is significantly influenced by regulatory compliance and sustainability initiatives. Governments worldwide are implementing stricter emissions regulations, prompting logistics companies to transition to greener delivery solutions. The adoption of electric and hybrid vehicles is becoming a necessity rather than an option, with many countries setting ambitious targets for reducing carbon footprints. In 2025, it is estimated that over 30% of new delivery vehicles will be electric, reflecting a shift towards sustainable practices. This regulatory landscape not only drives innovation in vehicle design but also encourages companies to invest in cleaner technologies. As sustainability becomes a core component of business strategy, the Parcel Delivery Vehicle Market is likely to see a transformation in vehicle offerings and operational practices.

Consumer Demand for Speed and Reliability

Consumer expectations for speed and reliability are significantly influencing the Parcel Delivery Vehicle Market. As competition intensifies among logistics providers, the pressure to deliver parcels quickly and efficiently has never been greater. In 2025, surveys indicate that over 70% of consumers prioritize fast delivery options, prompting companies to enhance their delivery capabilities. This demand drives the need for specialized vehicles that can handle high volumes of packages while ensuring timely deliveries. Additionally, the rise of subscription-based delivery services further emphasizes the importance of reliability in the logistics sector. Companies are increasingly investing in advanced delivery vehicles equipped with tracking technologies to meet these consumer demands. As a result, the Parcel Delivery Vehicle Market is likely to see a shift towards vehicles designed for speed and operational excellence.

Technological Advancements in Fleet Management

Technological advancements are playing a pivotal role in shaping the Parcel Delivery Vehicle Market. The integration of Internet of Things (IoT) devices and artificial intelligence in fleet management systems enhances operational efficiency and reduces costs. Real-time data analytics allows companies to monitor vehicle performance, optimize routes, and predict maintenance needs, thereby minimizing downtime. In 2025, it is projected that the adoption of smart fleet management solutions will increase by 40%, driven by the need for improved logistics efficiency. These technologies not only streamline operations but also contribute to better customer service by providing accurate delivery time estimates. As the industry embraces these advancements, the Parcel Delivery Vehicle Market is expected to evolve, with a focus on smarter, more efficient delivery solutions.