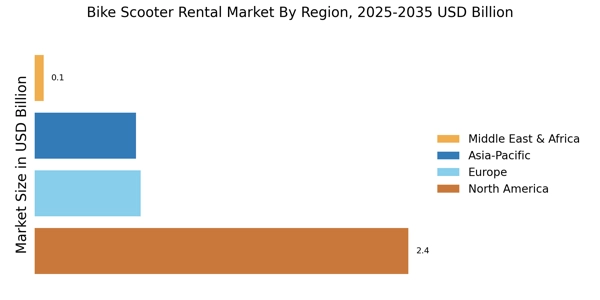

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Bike Scooter Rental Market dominated this market in 2022 (45.80%). Numerous cities in North America are home to sizable networks of buses, commuter trains, and subways. However, traveling to and from these transportation stops might be difficult a lot of the time. This critical void is filled by bike and scooter rentals, which offer commuters a convenient and environmentally friendly way to access public transportation.

Riders can, for instance, rent a scooter to get to a subway station quickly, improving the appeal and ease of public transportation. Further, the U.S. Bike scooter rental market held the largest market share, and the Canada Bike scooter rental market was the fastest growing market in the North America region. Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Bike Scooter Rental Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Bike scooter rental market accounts for the second-largest market share. This is due to the low cost of bariatric surgery and the rise in the number of diabetes people. The large and well-kept bike infrastructure in Europe is well-known. Numerous European towns support the use of bicycles and scooters for daily transportation and leisurely rides by providing designated bike lanes, bike-sharing programs, and bike-friendly regulations. Renting bikes and scooters is made convenient and secure by this infrastructure.

Further, the German Bike scooter rental market held the largest market share, and the UK Bike scooter rental market was the fastest growing market in the European region.

The Asia-Pacific Bike Scooter Rental Market is expected to grow at the fastest CAGR from 2023 to 2032. Key locations like residential neighborhoods, workplaces, and shopping districts are located close together in many Asian cities. For these brief distances, renting a bike or a scooter is a practical and affordable option. They work well for navigating crowded urban areas, traveling to school or work, and doing errands. Moreover, China’s Bike scooter rental market held the largest market share, and the Indian Bike scooter rental market was the fastest growing market in the Asia-Pacific region.