Top Industry Leaders in the Bike Scooter Rental Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Bike Scooter Rental industry are:

Lime (US)

Bird Rides, Inc (US)

Ofo Inc. (China)

TIER Mobility SE (Germany)

CITYSCOOT Tous droits reserves (France)

Uber Technologies Inc. (U.S.)

Mobycy (India)

Vogo Rental (India)

Lyft, Inc. (U.S.)

Zauba Technologies & Data Services Private Limited (India)

Spin (U.S)

Cooltra (Spain)

Bolt Technology OU (Estonia)

Yulu Bikes Pvt Ltd (India)

YEGO Urban Mobility SL (Spain)

Spinlister (U.S.)

Zoomo (Sydney)

Voi Technology AB (Sweden)

emmy-sharing (Berlin)

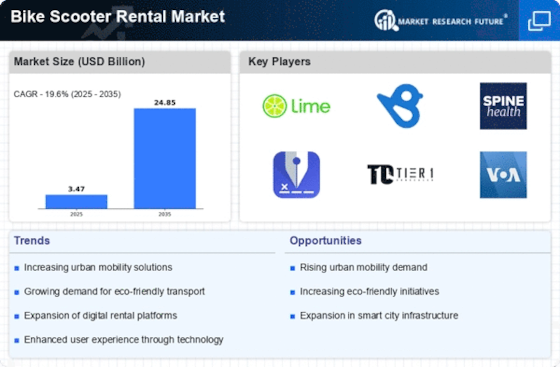

Bridging the Gap by Exploring the Competitive Landscape of the Bike Scooter Rental Top Players

The bike-scooter rental market is revving up, fueled by urban mobility demands, environmental consciousness, and tech-savvy riders. This dynamic landscape pits established players against nimble newcomers, all vying for a slice of the rapidly expanding pie. Analyzing their strategies, market share drivers, and emerging trends offers insights into the competitive scenario and future trajectory.

Key Player Strategies:

Market Leaders: Lime and Bird, the early birds, have established vast networks, robust app functionalities, and strategic partnerships with cities. They leverage economies of scale to offer competitive pricing and invest heavily in marketing and brand recognition.

Regional Champions: Dott (Europe), Voi (Scandinavia), and Yulu (India) carve niches through localized operations, catering to specific needs and regulations. They forge partnerships with local transit authorities and integrate seamlessly into existing transportation ecosystems.

Tech Disruptors: Jump (owned by Uber) and Lyft Bikes leverage existing user bases and integrate micro-mobility options into their broader transportation platforms. They prioritize seamless user experience and data-driven optimization for personalized journeys.

Market Share Analysis: A Multifaceted Game

Several factors influence a player's market share:

Fleet size and density: Availability and accessibility of vehicles are crucial, with strategic deployment in high-traffic areas maximizing utilization.

Pricing models: Dynamic pricing based on demand and distance, coupled with subscription options, attract diverse rider segments.

App functionality: User-friendly interface, intuitive navigation, and seamless payment integration are key for a smooth riding experience.

Safety and sustainability: Robust safety features, responsible riding initiatives, and commitment to green fleets (electric scooters) resonate with environmentally conscious users.

Regulatory compliance: Adapting to city-specific regulations and partnering with local authorities foster trust and ensure smooth operations.

New and Emerging Trends: Charting the Course Forward

E-bike boom: Electric bikes with longer range and higher speeds cater to longer commutes and diverse terrains, expanding the target audience.

Dockless vs. docked: The debate continues, with dockless offering flexibility but raising concerns about parking chaos, while docked systems ensure order but limit spontaneity. Hybrid models are emerging, offering the best of both worlds.

Integration with public transport: Seamless intermodality, allowing riders to switch between bikes, scooters, and buses/trains, fosters comprehensive urban mobility solutions.

Focus on safety: Advanced helmets, integrated lights, and geofencing technology are being adopted to minimize accidents and ensure rider safety.

Data-driven optimization: Leveraging user data to optimize pricing, fleet deployment, and maintenance schedules improves operational efficiency and rider experience.

Overall Competitive Scenario: A Dynamic Race

The bike-scooter rental market is characterized by intense competition, with constant innovation and adaptation being the name of the game. Established players maintain strong footholds, while regional champions and tech disruptors chip away at market share with niche offerings and tech-driven solutions. New trends like e-bikes and multi-modal integration hold immense potential, and a focus on safety and sustainability will be critical for long-term success. Ultimately, the companies that offer the most convenient, affordable, and responsible micro-mobility solutions will claim the pole position in this exciting race.

Latest Company Updates:

Lime (US):

- October 2023: Opened the first Lime "Life Store" in Santa Monica, offering rentals, charging, and retail for mobility products. (Source: Lime press release)

Bird Rides, Inc (US):

- June 2023: Acquired Scoot, a San Francisco-based e-scooter company, expanding its presence in the US market. (Source: Bird press release)

TIER Mobility SE (Germany):

- August 2023: Expanded its e-scooter and e-bike operations to 300 cities across Europe and the Middle East. (Source: TIER press release)