Shift in Consumer Preferences

A notable shift in consumer preferences towards convenience and flexibility is propelling the bike scooter-rental market. As lifestyles evolve, individuals are increasingly seeking transportation solutions that fit their dynamic schedules. The bike scooter-rental market industry is well-positioned to cater to this demand, offering on-demand rentals that allow users to access scooters at their convenience. In 2025, it is projected that the demand for flexible mobility solutions will increase by 40%, indicating a robust market potential. This trend suggests that rental services that prioritize user-friendly experiences and accessibility will likely thrive in the competitive landscape.

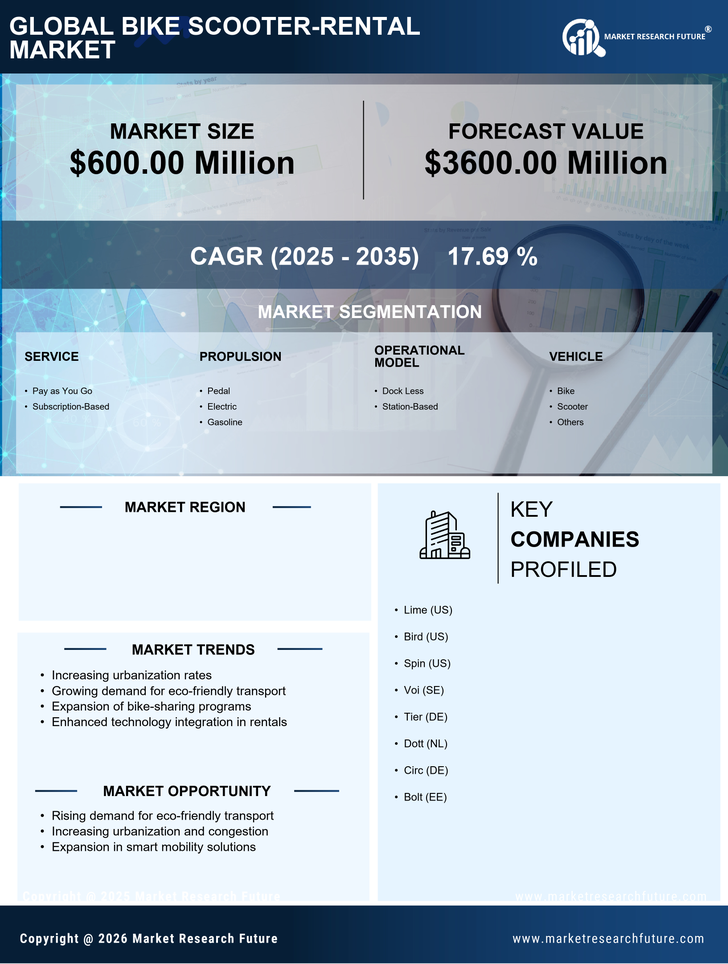

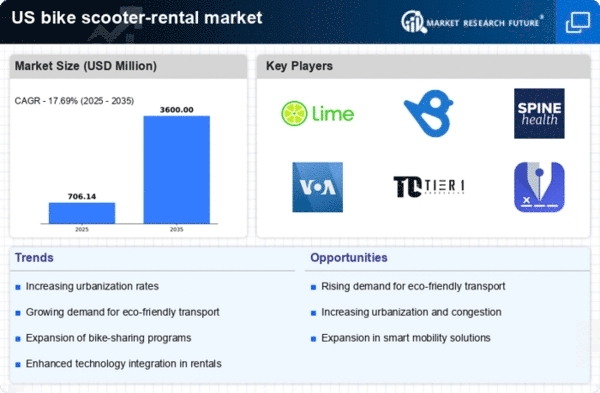

Rising Urban Population Density

The increasing urban population density in the US is a pivotal driver for the bike scooter-rental market. As cities become more congested, residents seek efficient and flexible transportation options. In 2025, urban areas are projected to house approximately 82% of the US population, leading to a heightened demand for alternative mobility solutions. This trend suggests that bike scooter rentals can alleviate traffic congestion and provide a convenient means of transport for short distances. Moreover, the bike scooter-rental market industry is likely to benefit from urban planning initiatives that prioritize sustainable transport options, further enhancing the appeal of bike scooters as a viable commuting choice.

Government Initiatives and Funding

Government initiatives aimed at promoting sustainable transportation are significantly influencing the bike scooter-rental market. Various federal and state programs are allocating funds to enhance bike infrastructure, including dedicated lanes and parking facilities. In 2025, it is estimated that over $1 billion will be invested in cycling infrastructure across major US cities. Such investments not only improve safety for riders but also encourage the adoption of bike scooters as a primary mode of transport. The bike scooter-rental market industry stands to gain from these initiatives, as they create a more conducive environment for rental services to thrive and expand.

Technological Innovations in Mobility

Technological innovations are reshaping the bike scooter-rental market, enhancing user experience and operational efficiency. The integration of mobile applications for seamless rentals, GPS tracking, and real-time availability has transformed how consumers interact with rental services. In 2025, it is anticipated that over 60% of bike scooter rentals will be facilitated through mobile platforms, indicating a shift towards digital solutions. Additionally, advancements in battery technology are likely to extend the operational range of electric scooters, making them more appealing to users. This evolution in technology suggests that the bike scooter-rental market industry will continue to grow as it adapts to consumer preferences and technological advancements.

Environmental Awareness and Sustainability

Growing environmental awareness among consumers is driving the bike scooter-rental market towards more sustainable practices. As individuals become increasingly conscious of their carbon footprint, the demand for eco-friendly transportation options rises. In 2025, surveys indicate that approximately 70% of urban residents prefer using rental services that promote sustainability. This shift in consumer behavior suggests that the bike scooter-rental market industry must align with these values by offering electric scooters and promoting green initiatives. Consequently, companies that prioritize sustainability are likely to attract a larger customer base, enhancing their market position.