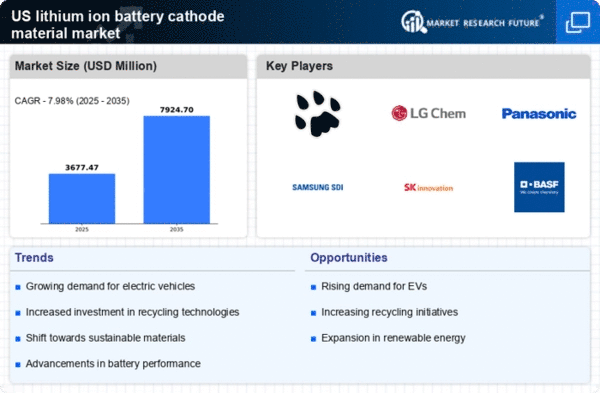

The lithium ion-battery-cathode-material market is currently characterized by intense competition and rapid innovation, driven by the increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Major players such as CATL (CN), LG Chem (KR), and Panasonic (JP) are strategically positioning themselves through technological advancements and partnerships. CATL (CN) has focused on expanding its production capacity and enhancing its research capabilities, while LG Chem (KR) emphasizes sustainability in its operations, aiming to reduce carbon emissions in its supply chain. Panasonic (JP) is also investing heavily in R&D to improve battery efficiency, which collectively shapes a competitive environment that prioritizes innovation and sustainability.Key business tactics within this market include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The competitive structure appears moderately fragmented, with several key players exerting influence over market dynamics. This fragmentation allows for a variety of strategies to coexist, fostering an environment where innovation and operational excellence are paramount.

In October LG Chem (KR) announced a partnership with a leading EV manufacturer to develop next-generation cathode materials that enhance battery performance. This collaboration is strategically significant as it not only strengthens LG Chem's position in the EV market but also aligns with the growing trend towards high-performance, sustainable battery solutions. Such partnerships are likely to accelerate technological advancements and market penetration.

In September Panasonic (JP) unveiled a new production facility in the U.S. dedicated to the manufacturing of advanced cathode materials. This move is indicative of Panasonic's commitment to meeting the increasing demand for EV batteries and signifies a strategic shift towards localized production, which may enhance supply chain reliability and reduce lead times. The establishment of this facility is expected to bolster Panasonic's competitive edge in the North American market.

In August CATL (CN) launched a new line of high-nickel cathode materials aimed at improving energy density and overall battery performance. This development is crucial as it reflects CATL's focus on innovation and its ability to respond to the evolving needs of the EV market. The introduction of these materials could potentially set new benchmarks for battery efficiency, further intensifying competition among key players.

As of November current trends in the lithium ion-battery-cathode-material market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage shared expertise and resources. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, underscoring the importance of agility and responsiveness in this dynamic market.